VAT MOSS Reports

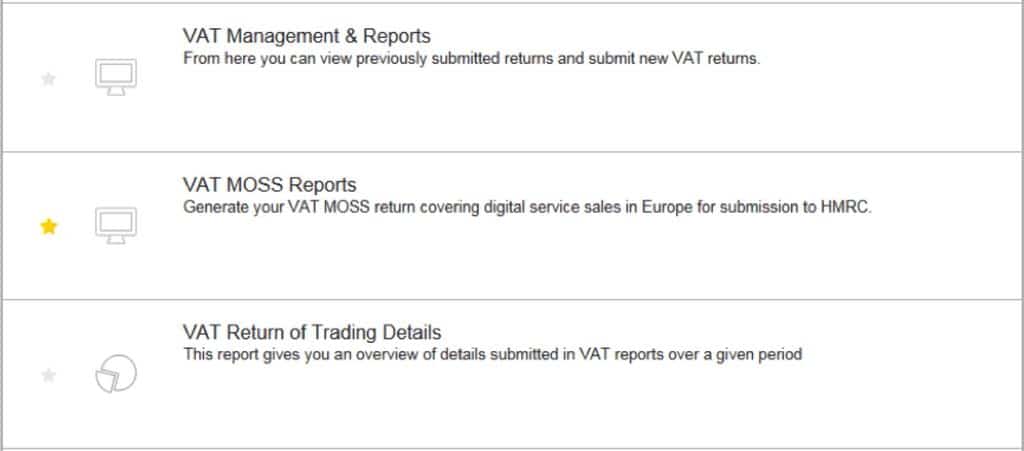

In order to submit your single VAT MOSS return, you will first need to run a VAT MOSS report within KashFlow. In order to generate this, click on Reports in your navigation bar and under General Reports, select VAT MOSS Reports.

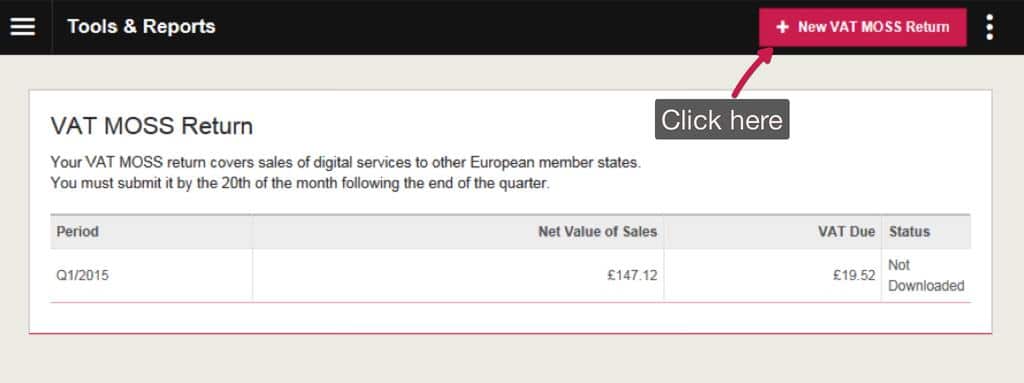

Create New

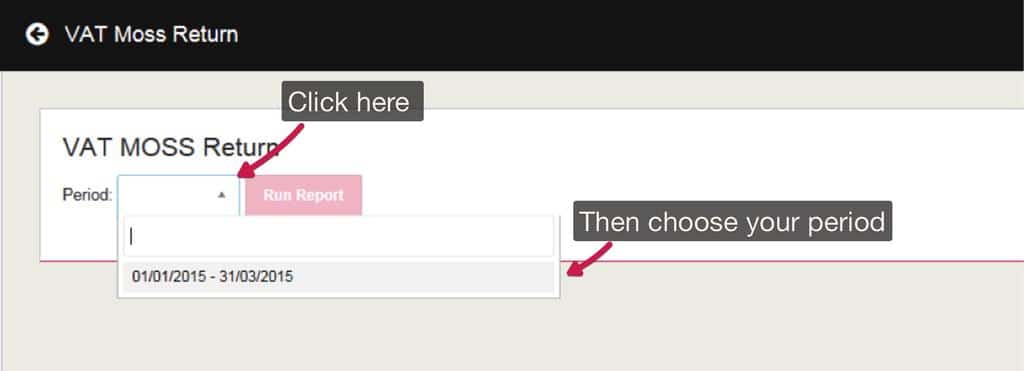

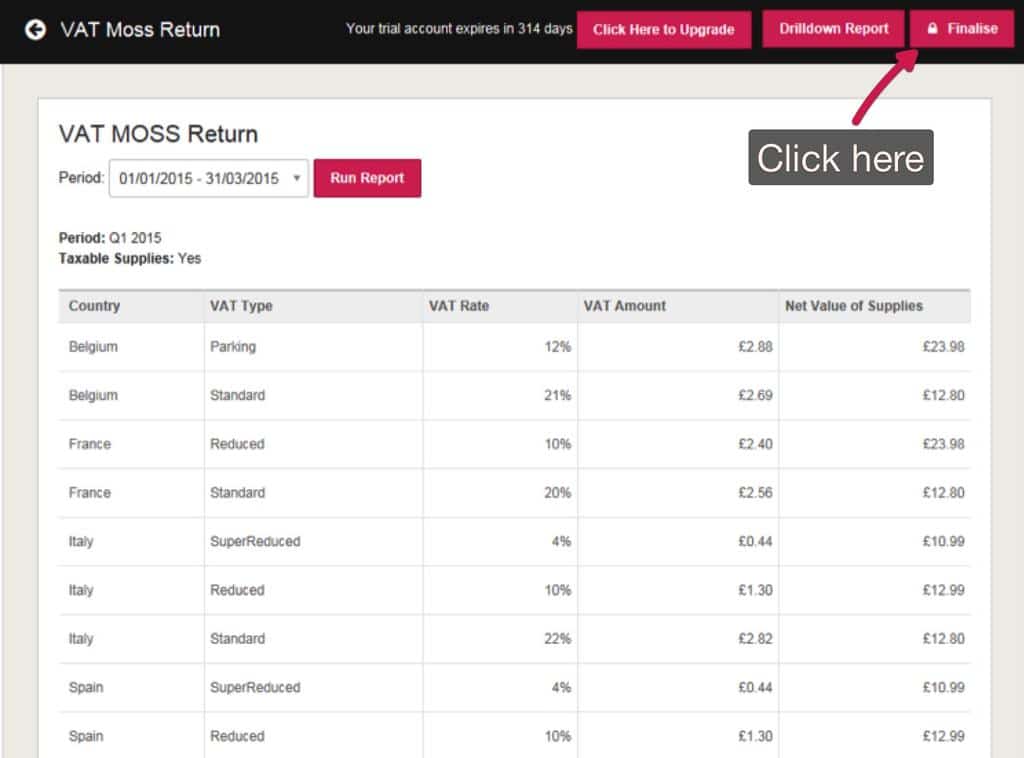

Select the option to create a New VAT MOSS Return, select your desired period and click Run Report. This will then pull digital services invoices for consumers and display them by country with the corresponding VAT rate.

- If at any point you realise a mistake on your VAT MOSS return, you can delete and re-complete your return. Returns that have been submitted can be corrected if within a 3 years and 20 days period.

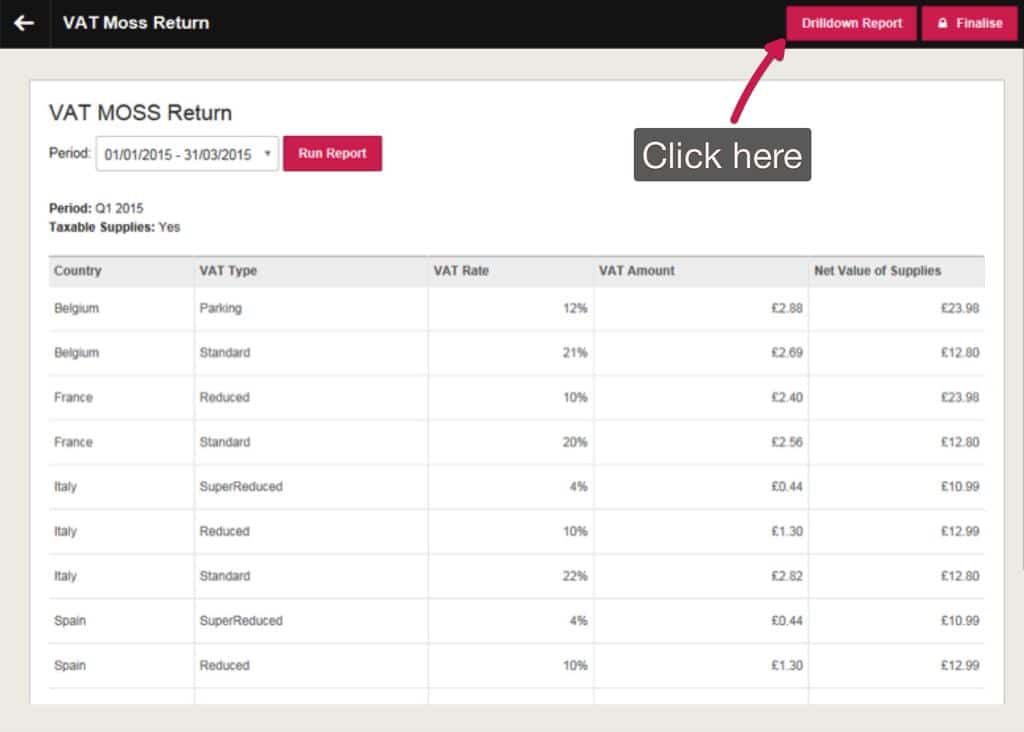

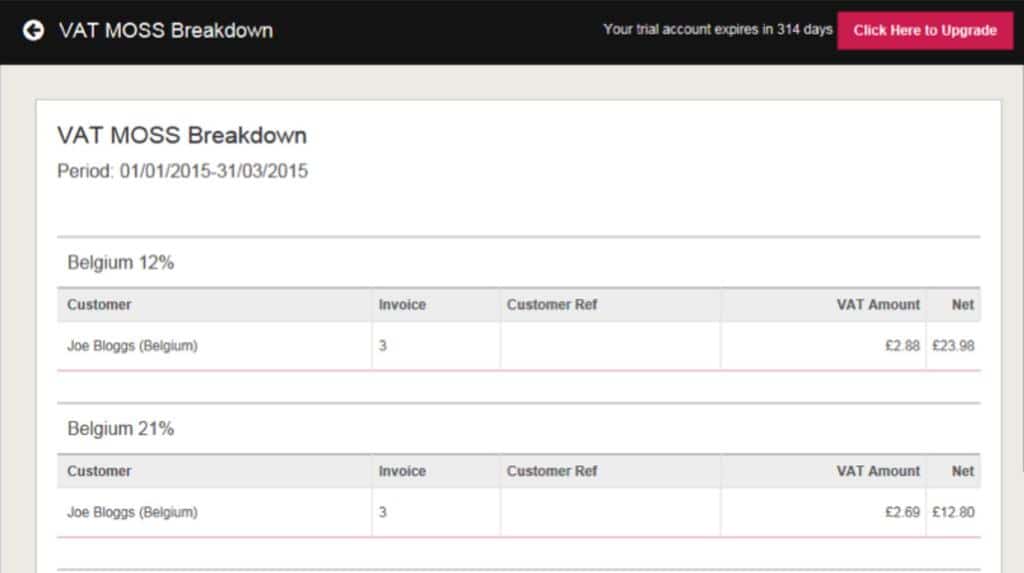

Drilldown Report

Your VAT MOSS report will be displayed on screen. At this point, it has not been finalised. Information will be sorted by country in alphabetical order and by VAT Type. Should you wish to view a drilldown report that will display further information, please click Drilldown Report

Finalise and Submit

Step 1

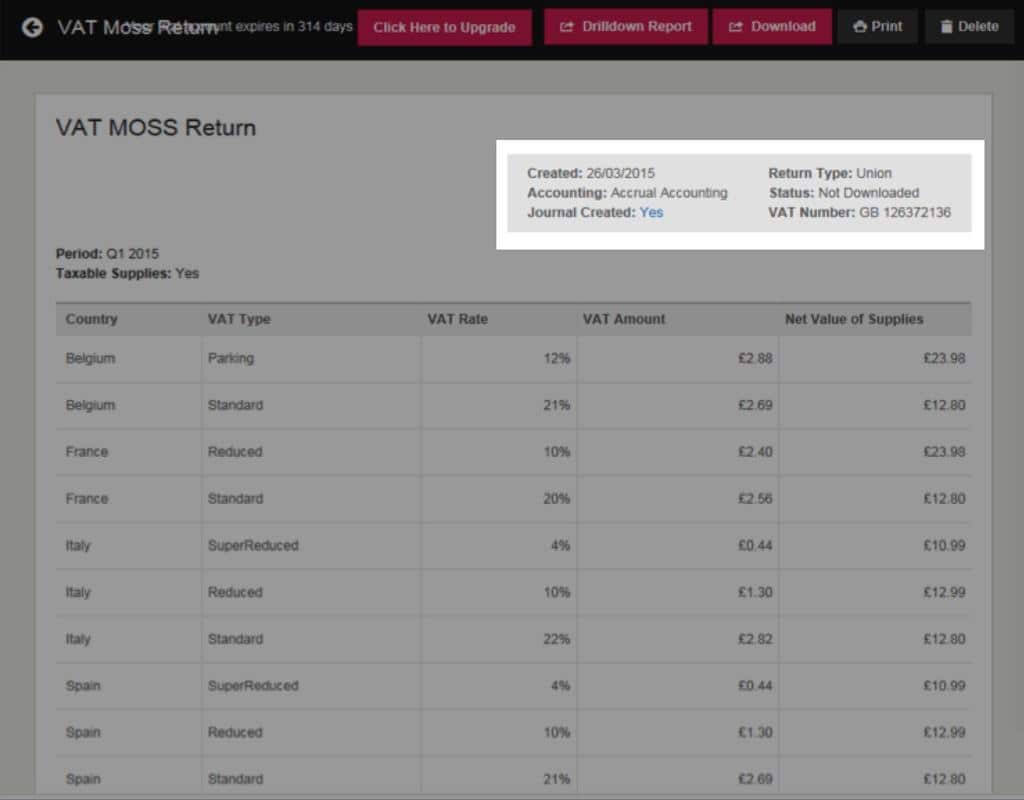

When you are ready to submit your VAT MOSS report, click Finalise. Your final return will then be shown on screen with confirmation that a journal has been created, and confirmation of return type and status. You will then need to download this report and move to step 2

Step 2

Once you have downloaded your VAT MOSS Report, you will need to then submit this to the HMRC using the HMRC Online Services. How you submit your return will depend upon whether you are classed as Union or Non Union.

- You will fall under Union if you are trading in the UK and submitting information to the HMRC

- Non Union businesses are trading outside the UK but still report to the HMRC

For further information on submitting your VAT MOSS Return to the HMRC, please follow the relevant link below;

Once you have completed the templates provided, you must log into the HMRC Online Services with the User ID and password you used to register for VAT MOSS (ie the same one you use to submit UK VAT Returns) to submit your information.