New functionality has been introduced to Kashflow payroll which will allow users to resend RTI submissions without needing to rollback.

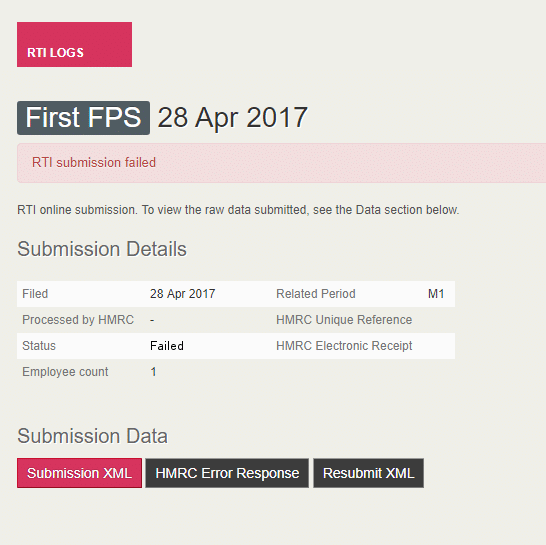

Found in Payroll | Online Filing | Submission Details, if your RTI submission was rejected by HMRC you will have the opportunity to either “Resubmit XML” or “Update PAYE“.

Resubmit XML

This option will be displayed if your submission was rejected with one of the following HMRC responses:

- 1000 – System failure

- 2000 – unique submission ID could not be found

- 2005 – acknowledgment missing

- 3000 – failed due to unspecified error

- empty – submission failed, no reason provided

Update PAYE

This option will be displayed if your submission was rejected with the following HMRC response:

- 1046 – HMRC Authentication details are incorrect

This error occurs when either your PAYE office number, reference number or Accounts Office number do not match with HMRC records. Once you click “Update PAYE” you then have the opportunity to correct the detail that has caused the error. Any changes saved here will be reflected on the company government screen, correcting your submission for future periods.