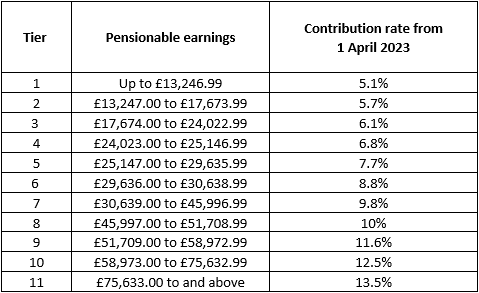

We have recently updated the pension tiers for the NHS Pension Scheme for England/Wales for 2023/2024 following the changes announced recently; the changes to the pension tiers apply from 1st April 2023. In addition to this, the AfC Pay Awards have also been announced, also with the instruction to backdate to 1st April 2023.

Please note:

NHS Business Services Authority has advised that although the uplift to thresholds applies to periods already processed, they anticipate that limited employees’ tier threshold – and therefore rate – will change since the pension thresholds have uplifted to coincide with the uplift in pay awards (5%).

The above means that if an employee receives the same payment each month; there is no requirement to recalculate previous pay periods. If there are any payments due for the arrears for the AfC pay award, include these in the current pay period; the payment of the arrears should have pension contributions deducted at the normal rate, i.e., if payment of the arrears causes the pensionable pay to fall into a different tier, do not increase their pension rate.

If the employee’s pay fluctuated in previous months to include overtime, unsocial hours, etc. you must check if including the pay award in that pay period would have caused pensionable pay to move into a new tier. If so, you must set the employee’s pension rate in accordance with the new tier and recalculate the previous months.

What do I need to do now?

After v1.8.6 was released on Tuesday 20th June, the system automatically set the percentage rate using the new pension thresholds based on the calculation: basic monthly salary x 12.

You can print a report that will display the old and new pension rates. This can be printed from Reports | GP Pension Reports | Pension Rate (June 2003)

If you have other pay elements that should be used when setting the employees’ rate, then you must calculate what the pension contribution rate should be manually. Set the rate in Employees | NHS Pension | NHS Pension | Employee Basic Rate Contribution, and then recalculate the pay period for the employee. Do not include any pay award arrears amount when setting the pension contribution rate in the pay period.

If the employee is paid the same amount each month, then you should not need to backdate the changes for previous pay periods. If the employee received fluctuations in pay or did not receive a pay award then changes may be required. You may need to recalculate the previous pay period, using the percentage rate that would apply for the new pension thresholds.