Contents

This document aims to give you guidance on processing payments in KashFlow Payroll with respect to changes in legislation and HMRC recommendations in the current climate.

Topics currently included:

Temporarily Stop Deduction of Direct Earnings Attachments (DEA)

The Department of Work and Pensions (DWP) is writing to employers asking them to temporarily stop benefit debt repayments. You should not make any DEA deductions to your employees’ pay in April, May or June 2020. You’ll be told if this will be extended.

To do this in KashFlow Payroll

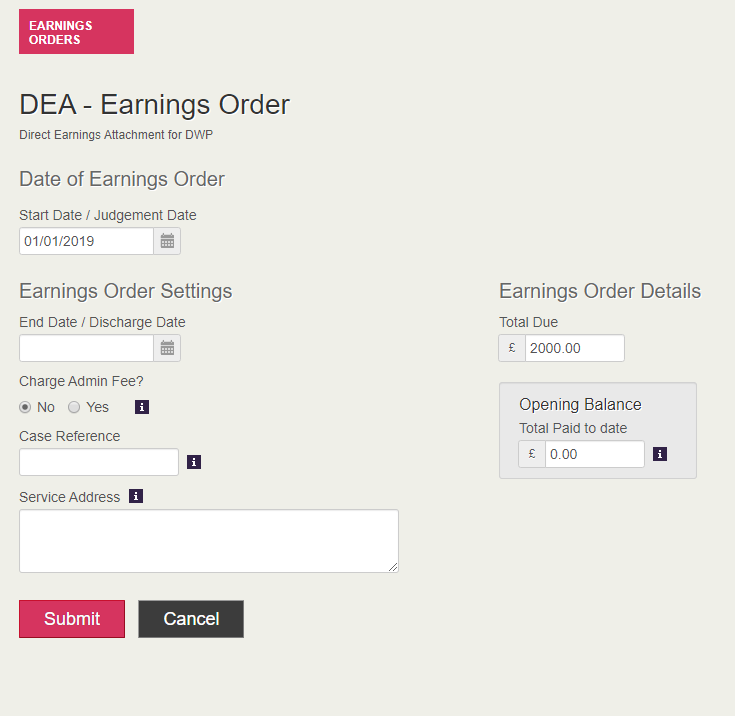

Go to Employees – Earning Orders and select any earnings orders listed to edit them.

This opens up the dialogue shown below.

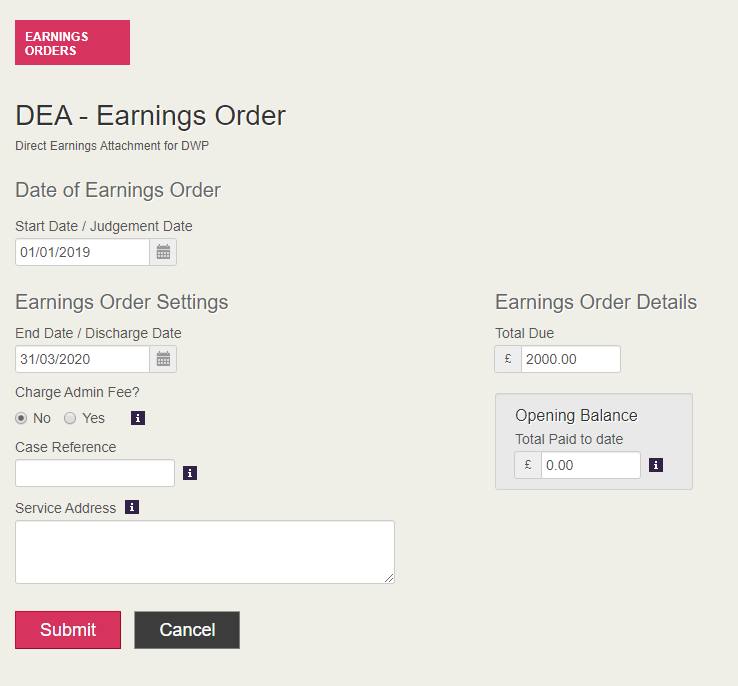

In the End Date / Discharge Date field, enter the last date of the pay period prior to April 2020 and click Submit.

This will stop any deductions for the attachment of earnings order on the employee’s payslips.

You will need to remove the end date when you are advised to start taking the deductions again, currently planned for July 2020.

For more information see https://www.gov.uk/government/publications/direct-earnings-attachments-an-employers-guide

Furlough Payments

This section aims to give you guidance on processing Furlough payments in KashFlow Payroll, making it easier to calculate what you can claim back from the government using the Coronavirus Job Retention Scheme. Further information can be found here.

Payslip item

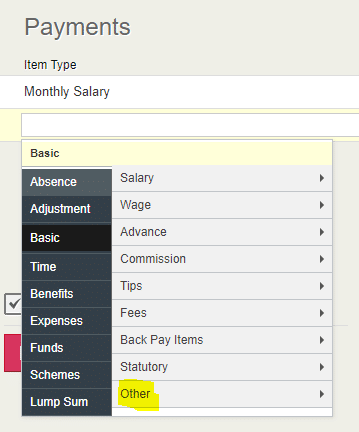

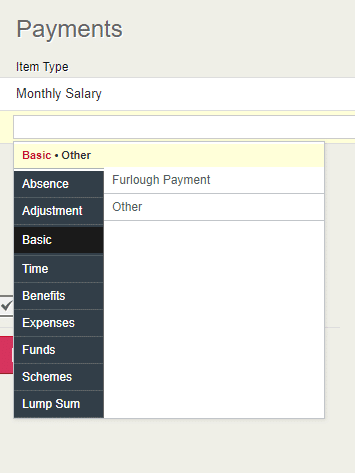

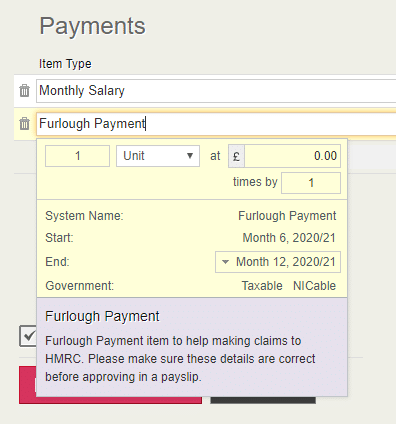

We have added a new Furlough Payment payslip item which is available in the payslip item selection box under Basic / Other.

To use this when creating a payslip for someone who is furloughed, choose the payslip item from Basic / Other / Furlough Payment.

The payment is subject to tax and NI and is part of Qualifying Earnings and Pensionable Earnings.

This will create a payslip item which you can complete as normal.

Things to consider

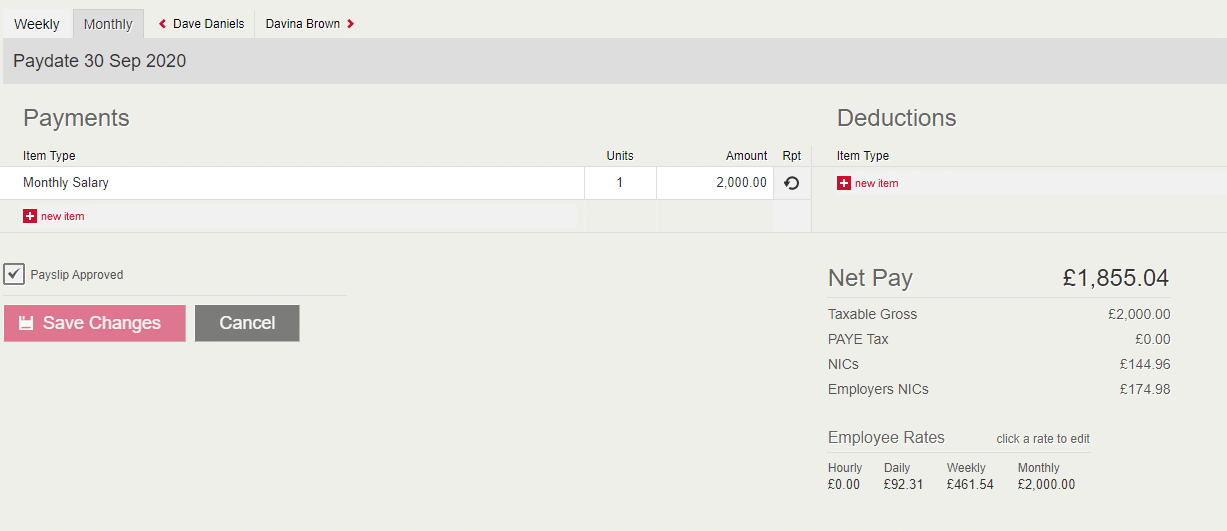

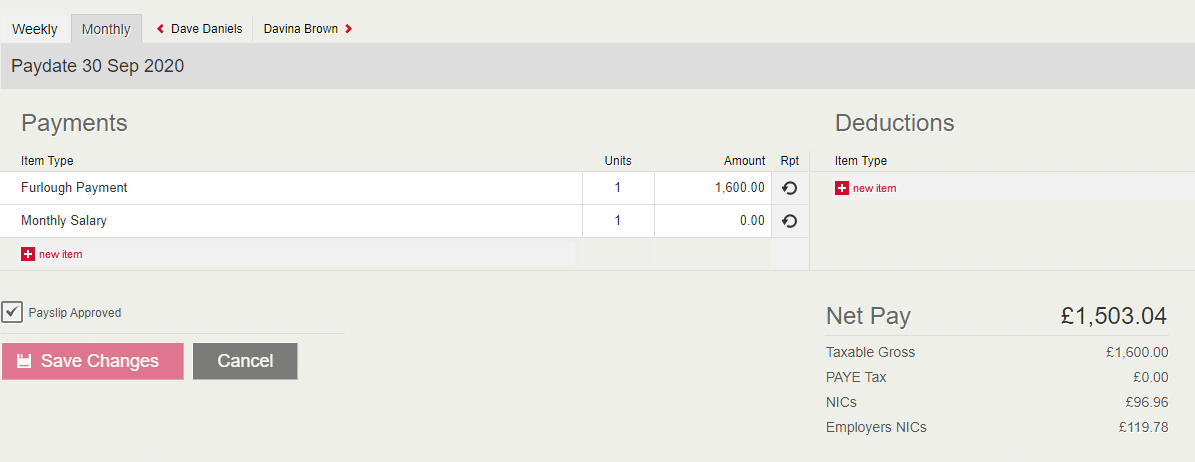

- You may have to alter any normal payment the employee receives, e.g. if you do have a regular payment set up for this employee you could temporarily set that to zero or alternatively add another payslip item which deducts the amount to make it zero. If you want to continue paying your furloughed employee 100% of their pay you could temporarily set the repeated pay to be 20% of its original value

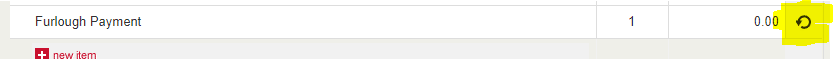

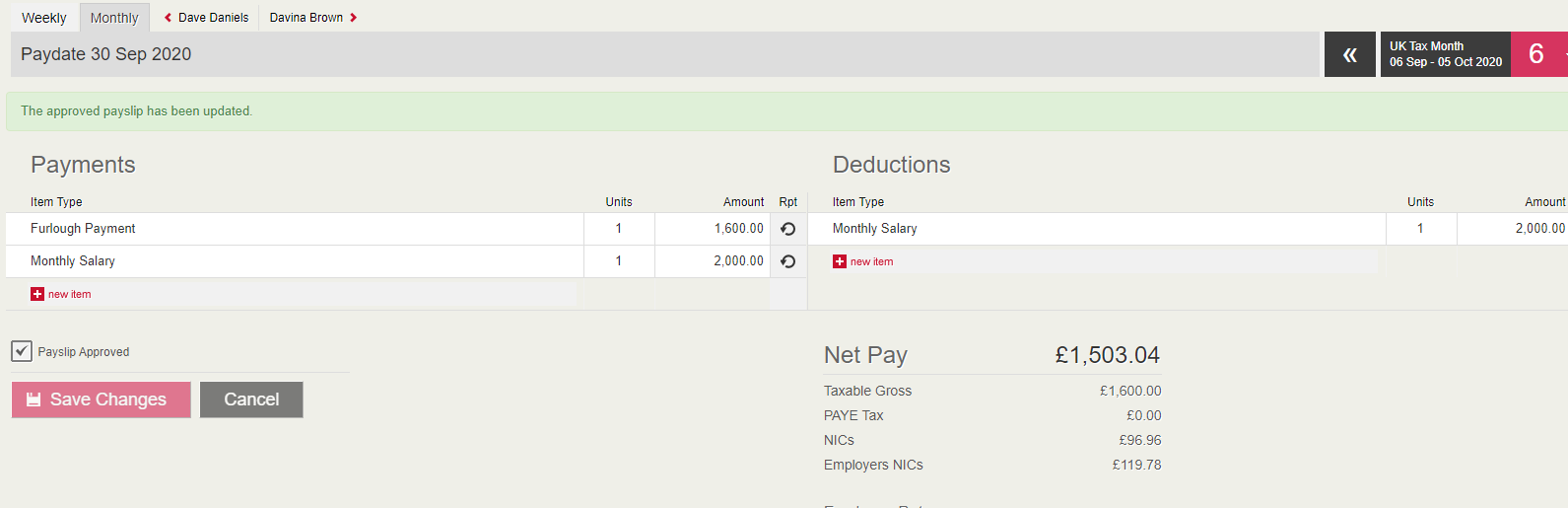

- You can make the furlough payment repeat each pay period using the repeat function (the icon you need is highlighted in the example below)

Payslip – normal salary without furlough payment

Furloughed Payslip – option 1 – change normal salary

Furloughed Payslip – option2 – deduct normal salary

Employer Pension Contributions

HMRC State that you cannot claim any automatic enrolment contributions above the minimum mandatory employer contribution of 3% of income (above the lower limit of qualifying earnings which is £512 per month until 5th April and will be £520 per month from 6th April 2020 onwards).

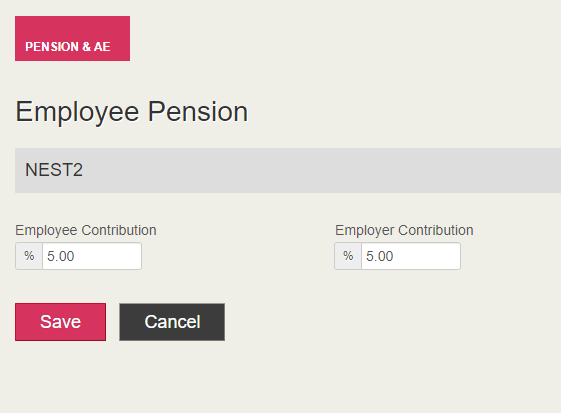

If you provide more than 3% in employer’s pension contributions and do not want to be out of pocket for furloughed employees, you must reduce the employer contribution.

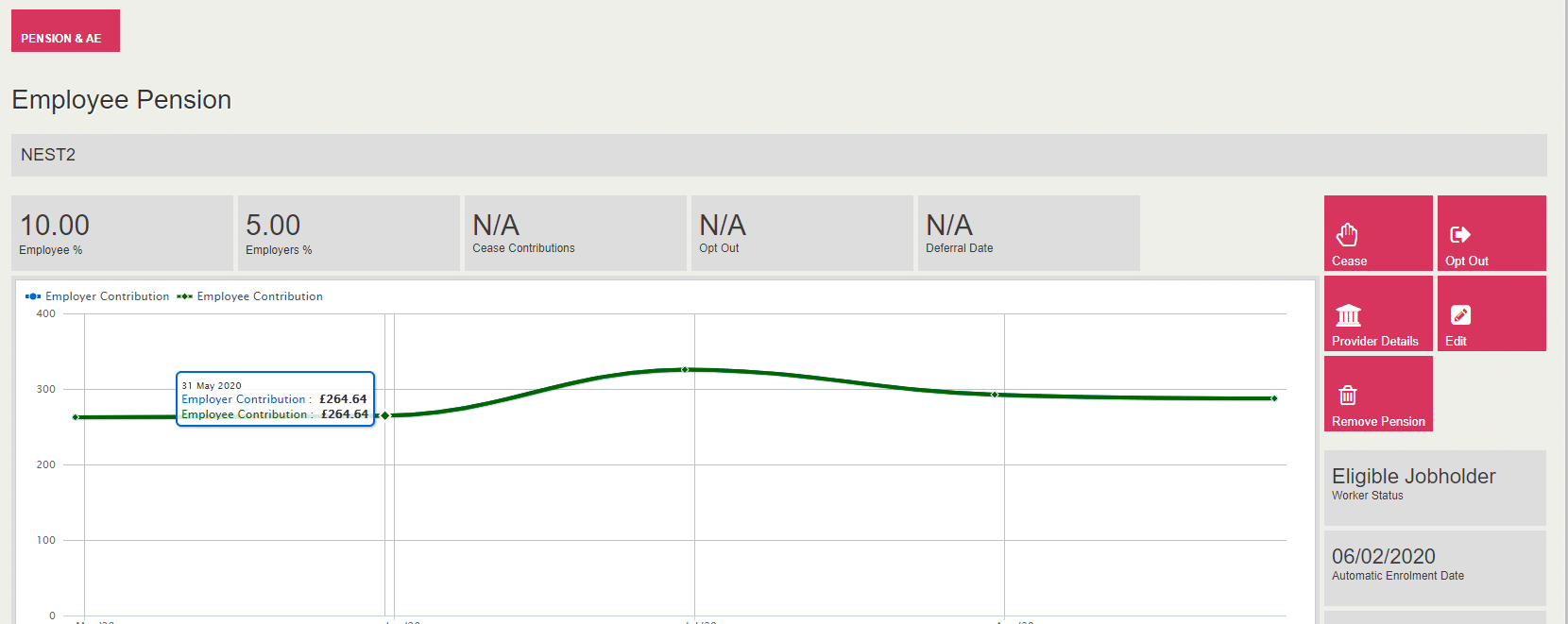

To do this, go to the employee’s pension record and click Edit.

This opens a new screen allowing you to modify the pension contribution amounts for the selected employee.

How much money do I claim?

You will receive a grant from HMRC to cover the lower of 80% of an employee’s regular wage or £2,500 per month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that subsidised wage.

How to create a report to calculate how much I can claim

What I need to know

Assuming you use the Furlough Payment payslip item for Furlough Payments.

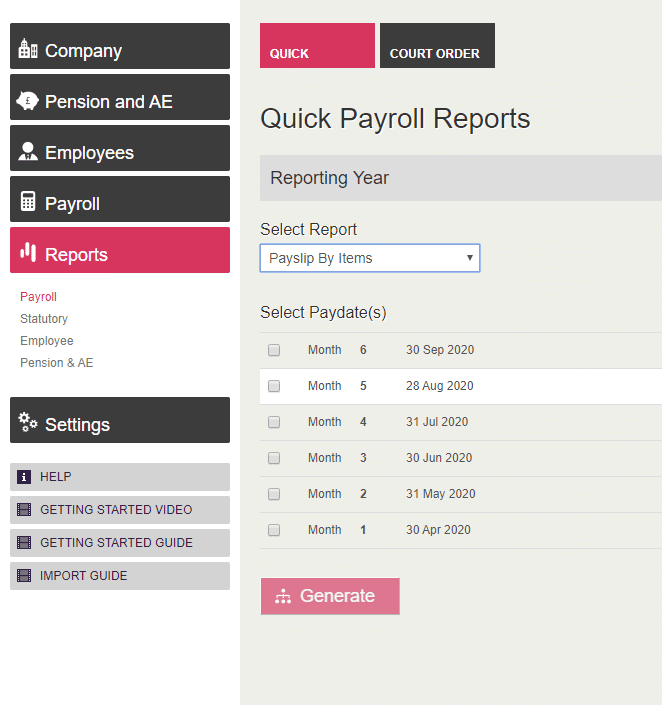

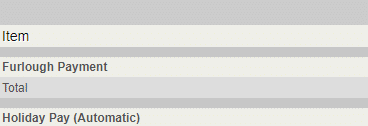

Run the Payslip By Items report with the required pay period selected, found under Reports | Payroll.

This will give you a report with a line item for the total amount of furlough payments made in each pay period selected.

For the time being use the amounts on furloughed employee payslips to help ascertain the amount of Employer’s NI and Employer’s minimum pension contributions you can claim.

Pensions

HMRC State that you cannot claim any automatic enrolment contributions above the minimum mandatory employer contribution of 3% of income (above the lower limit of qualifying earnings which is £512 per month until 5th April and will be £520 per month from 6th April 2020 onwards).

Employee is furloughed for part of a pay period

If an employee is furloughed part way through a pay period only a portion of the employer’s NI and employer’s pension will apply to the furlough payment.

Assuming a monthly paid employee with annual salary of £24,000 being paid in April 2020/2021. The employee is paid from April 1 to April 30, works Monday to Friday and is furloughed from Monday 13th. The employee has 12 working days and 18 furloughed days in April. The employee in this example is on NI Letter A and has contributed 3% to an Automatic Enrolment scheme on earnings above £520.

| Normal pay | £2000 / 30* 12 | £800.00 |

| Furloughed pay | £2000 / 30 * 18) * 80% | £960.00 |

| Total Pay for month 1 | 1760.00 | |

| Employer’s NI on Gross of 1772.31 | 141.86 | |

| Employer’s Pension on Gross of 1772.31 | 37.20 |

Proportion to claim back

You can claim back the proportion of the NI and pension associated with the furlough payment.

Employer’s NI

The calculation is (Normal pay + Furloughed pay – NI Secondary Threshold) * Employers’ NI rate above Secondary Threshold

(£800 + £960 – £732) * 13.8% = £141.86

£141.86/ 30 * 18 = £85.11

Employer’s Pension

The calculation for pensionable pay is (Furloughed Pay – Lower level of qualifying earnings / Days in Month * Furloughed Days in Month)

£960 – (£520 / 30 * 18) = £648*

£648 * 3% = £19.44

*This amount is capped for furloughed pay reclaim purposes at the sum of (Upper level of qualifying earnings – Lower level of qualifying earnings)

Note: The Payroll software will not calculate this for you.

Paying Employees 100% of Pay

If you are paying employees 100% of pay while furloughed, you will have to work out how much employer’s NI and employer’s pension you can claim back.

Example

I pay an employee £3500 which is 100% pay). NI Letter A. Pension is 3% above £520.

£2500 is identified in the payroll as a separate payment element for furloughed pay.

Employer’s NI is £381.98

Employer’s Pension is 89.40

I pay max of £2500 therefore I can reclaim

Employer’s NI: £2500/3500 * 381.98 = £272.84

Employer’s Pension: £2500 – £520 * 3% = £59.40

Employee Payment: £2500.00

Total reclaim is £2500.00 + £272.84 + £59.40 = £2832.24

Employment Allowance

What information do I need to make a claim?

- Company Name

- Company CRN (Companies House number) – Mandatory unless the next two below are both completed

- Corporation Tax Unique Taxpayer Reference – Mandatory if Company CRN not provided

- Self-Assessment Unique Taxpayer Reference – Mandatory if Company CRN not provided

- PAYE Reference

- Claim Period Start Date

- Claim Period End Date

- Number of Employees being furloughed

- Amount Claimed for Gross Pay to Employees on Furlough for the Period

- Amount Claimed for Employer NICs Contributions for Furloughed Employees

- Amount Claimed for Employer’s Auto-Enrolment Pension Costs for Furloughed Employees

- Total Claim Amount

EMPLOYEE DETAILS per each employee claiming for

- Employee’s Full Name

- Employee’s National Insurance Number

- Employee’s Payroll Reference Number – OPTIONAL

- Employee claim amount

- Employee furlough start date

- Employee furlough end date

BANK DETAILS for the claimed funds to be paid into

- Bank Account Number

- Bank Sort Code

- Bank Account Holder’s First Name – Mandatory if claim being paid into a personal bank account

- Bank Account Holder’s Last Name – Mandatory if claim being paid into a personal bank account

- Bank Account Holder’s Address – Mandatory if claim being paid into a personal bank account

- Building Society Roll Number – Optional (only needed if relevant)

- Company Address – Mandatory if claim being paid into company bank account

CONTACT DETAILS for person making the claim

- Contact Name

- Contact Number

If you use an agent who is authorised to act for you for PAYE purposes, they will be able to make a claim on your behalf. If you use a file only agent (who files your RTI return but doesn’t act for you on any other matters) they won’t be authorised to make a claim for you and you will need to make the claim yourself. Your file only agent can assist you in obtaining the information you need to claim (which is listed above). HMRC are endeavouring to make the claim process as straightforward as possible, for further information see:

- https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme

- https://www.gov.uk/guidance/work-out-80-of-your-employees-wages-to-claim-through-the-coronavirus-job-retention-scheme?utm_source=050b4a63-453d-4aed-93ce-67e981006b92&utm_medium=email&utm_campaign=govuk-notifications&utm_content=immediate