Welcome to release 1.4.9.

This update of the software includes some new features and enhancements relating to the processing of furlough payments:

- Add furlough pay and associated top-ups to a payslip:

- use the furlough top-up payslip item

- Record furloughed dates for an employee

- Create a claim for furlough pay:

- setup a claim period

- view and update details for a claim

- produce a report for manual entry or an output file for upload into the HMRC claims portal

We have also included two further considerations affecting furlough pay and furlough pay claims at the bottom of these release notes relating to Employment Allowance and Statutory Pay.

Add furlough pay and associated top-ups to a payslip

The calculation relating to employers’ National Insurance claims for furlough pay requires an explicit entry on a payslip for any amount of top-up pay whilst an employee is furloughed.

We have added a new payslip item type to help you to do this. We recommend you use this payslip item, together with the furlough payment payslip item previously released, in order to automatically generate your claims.

If you have already paid furloughed employees top ups to their furlough pay or paid furlough pay itself without using one or both of those two payslip items, the claim amounts are editable and can be updated manually as part of the claim creation process detailed below.

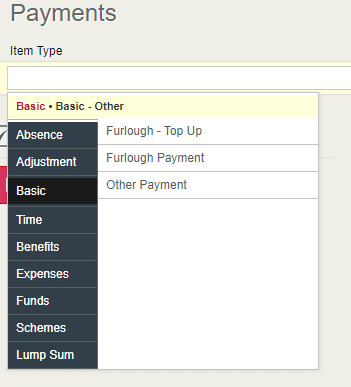

In the Payroll | Payslips & Periods view:

We have added a new Furlough – Top Up payslip item which is available in the payslip item selection box under Basic / Basic – Other, above the existing Furlough Payment payslip item.

Use this when adding an amount of top-up pay to a payslip for someone who is furloughed, used in tandem with the furlough payment payslip item.

- The top up payment is subject to tax and NI and is part of Qualifying Earnings and Pensionable Earnings.

- Using this option will create a payslip item which you can complete as normal.

- Furlough top-up payments are used , in conjunction with furlough payments, to calculate the employers’ National Insurance part of a Furlough claim.

- Furlough top-up payments represent pay, in addition to furlough payments of 80% of salary, paid to the employee increasing their total pay while furloughed up to a maximum of 100% normal pay.

Record furloughed dates for an employee

The calculations relating to employers’ National Insurance & Pension contribution claims for furlough pay require a record to be kept of the dates an employee has been furloughed; both calculations require the number of days an employee was furloughed in the pay period.

We have added a new tab within KashFlow Payroll to help you to do this.

The minimum amount of time an employee can be furloughed is three weeks.

If you need to extend this period later just delete the one you already entered and add a new longer period instead.

If the employee returns to work after one of these periods of furlough, enter any later periods of furlough as separate periods of a minimum of three weeks in length.

If you have already claimed some furlough pay from HMRC we recommend you enter historical furloughed dates for employees here to help you keep a record.

To accommodate the creation of Furlough Payment Claims we have made the following changes:

On the Company | Payments & Receipts view:

- We have added two new tabs, Furlough Claims & Furlough Dates

Click on the Furlough Dates tab to open that view.

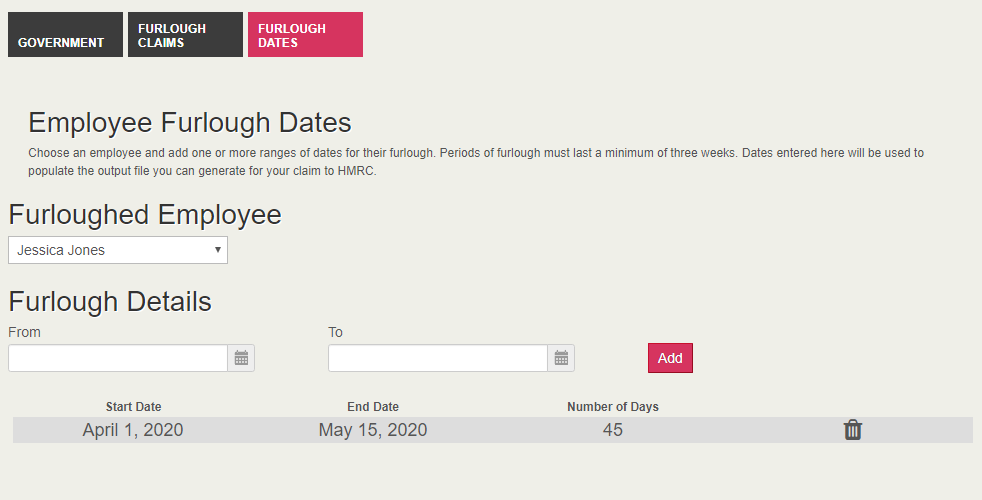

On the Company | Payments and Receipts | Furlough Dates tab:

- Add a furlough record for an employee:

- Use the Furloughed Employee dropdown to choose an employee

- Use the From and To Furlough Dates to enter the period of furlough

- Click on Add to record the furlough period – this will be used in the claims calculation

- The record created shows the date range & number of calendar days furloughed

- Delete a furlough record:

- Use the trashcan icon at the end of the record row

- Extend a furlough record:

- Use the trashcan icon at the end of the record row to delete the record

- Create a new record with the new date range

Create a claim for furlough pay

Set up a claim period

HMRC have provided a portal to make furlough claims. In order to help you KashFlow Payroll has some new options to create claim periods to base these claims from.

A claim period is a range of dates which include one or more pay dates you are claiming for.

At the time of writing HMRC have mandated that claim periods cannot overlap.

To set up a claim period in KashFlow Payroll:

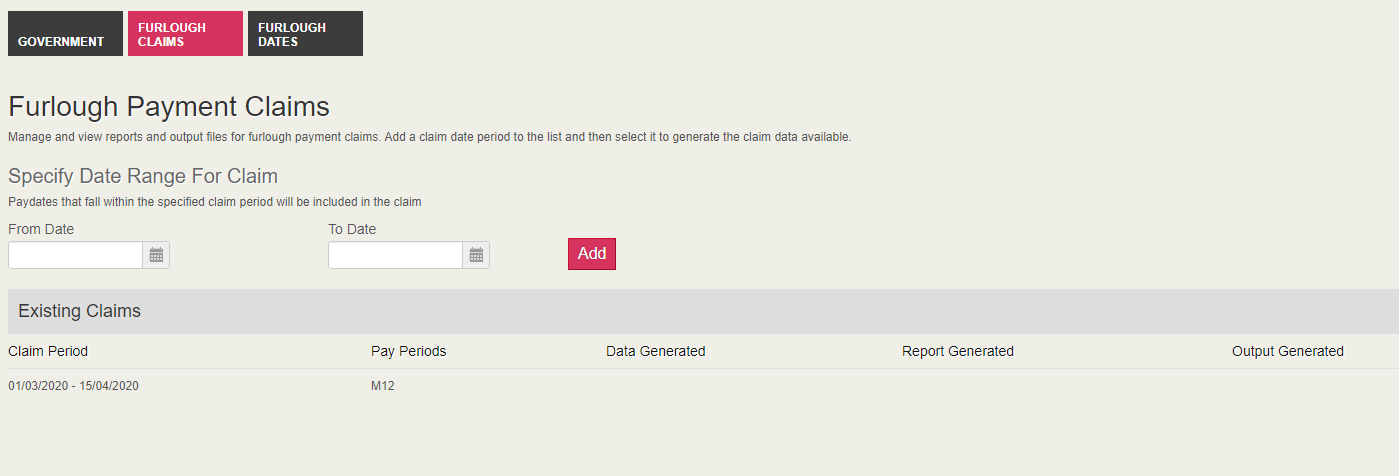

- Navigate to the Company | Payments & Receipts | Furlough Claims view

- Choose a From Date and To Date for the range of the claim

- Click on Add

- A claim will be added below which will show which pay periods have pay dates included in that claim

If you choose a claim period which includes pay dates from unfinalised pay periods you may receive a warning

To delete a claim period, hover on the period to display a trash icon at the far right that you can click on to remove it.

Add further claim periods as needed.

To view and update the details of a claim, click on the claim itself.

Note: If you are claiming over a tax year and have a weekly pay roll you may need to claim separately for each tax year’s portion.

Data Generated: This column shows the date you first click on a claim period to view and update the details of a claim

Report Generated: This column displays the date you last created a pdf report for the claim

Output Generated: This column displays the date you last created an output file for the claim

View & Update Details for a Claim

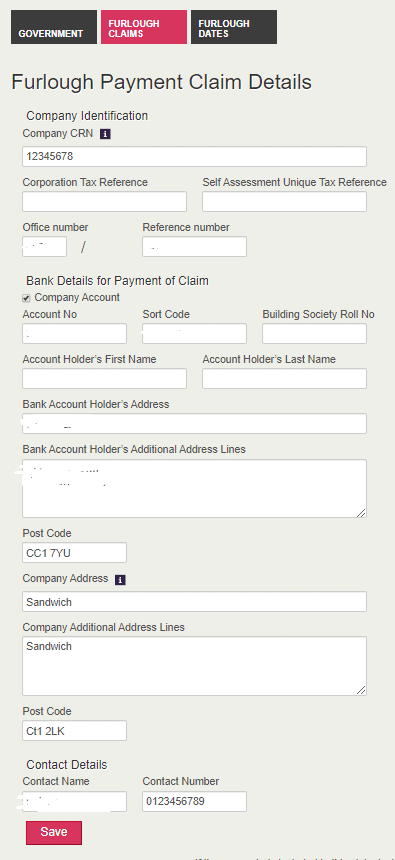

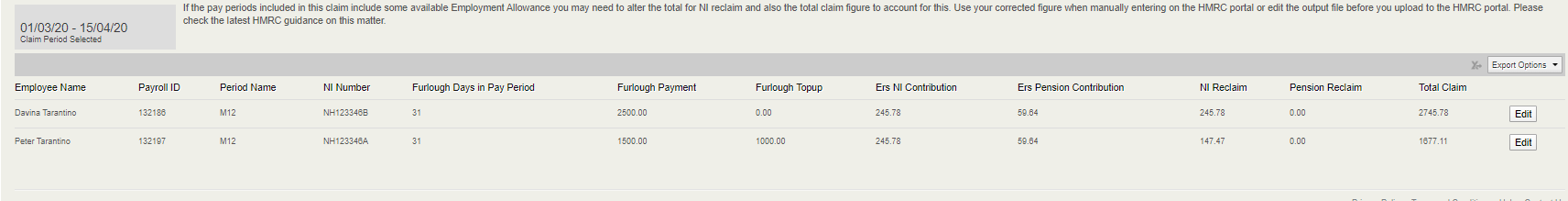

Clicking on a claim opens the details view. The details view is split into two sections.

The top section includes all the fields necessary for inclusion in an output file if you are going to be uploading a file to HMRC’s portal.

You will also need most of this information for a manual claim entry though you do not need to save it here for that purpose.

The information in this top section pertains to all claims you make once saved.

The bottom section houses the details for the claim period broken down for each employee in each pay period separately. The reason for this is that calculations are per pay period, not claim period.

As well as basic employee details this section gives you the following information:

- Furlough Days in Pay Period: the number of days relating to the dates you have marked that employee as furloughed that coincide with the dates in the pay period. If this value is incorrect you can update it in the Furlough Dates tab for the employee and return to this claim.

- Furlough Payment: the amount of pay on the payslip identified by the furlough payment payslip element

- Furlough Topup: the amount of pay on the payslip identified by the furlough top-up payslip element

- Ers NI Contribution: the amount of Ers NI relating to the employee in the pay period

- Ers Pension Contribution: the amount of Ers Pension Contribution relating to the employee in the pay period

- NI Reclaim: the amount of Ers NI reclaim suggested based on information given above

- Pension Reclaim: the amount of Ers Pension contributions reclaim suggested based on information given above

- Total Claim: the total amount of claim suggested based on information given above

Note: SOME MANUAL CHANGES REQUIRED: Some claim amounts may need to be altered manually by the maximum allowed by HMRC for a pay period, or due to a pro rata of furlough days. Check the latest HMRC guidance on this matter.

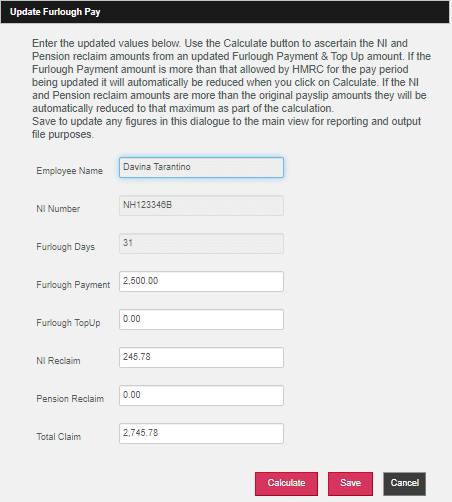

Edit: Click this button to modify most of the parameters to recalculate or manually amend the claim figure using the dialogue below. This might be necessary if you have not used either of the two specialised payslip elements for either furlough payment or furlough top-up and need to identify those amounts.

Correct an employee’s information by updating the fields in the dialogue.

Note: PENSION RECLAIMS: The calculator will award a pension reclaim if the employee is currently in a pension scheme. You may need to remove it if they were not in a pension scheme at the time of the pay period concerned.

Note: PART-PERIOD FURLOUGH: The calculator will not check for legitimate amounts of pro rata furlough pay – if the employee was on furlough for less than a full month, the maximum allowance for furlough pay should be the same fraction of the maximum of £2500, so for example £1250 furlough pay if the employee was only on furlough for half the month. Please ensure these are entered correctly and also check the corresponding NI and pension reclaim amounts. Check the latest guidance from HMRC on this matter.

Calculate: click to recalculate the amounts of claim based on the data entered

Save: save any changes you have made, either manual or calculated, back to the main claim view.

Cancel: return to the main claim view without saving

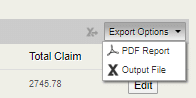

Produce a report or output file for the claim

The top right of the table in the bottom section of the claim details page includes the Export Options.

PDF Report: save a pdf report that gives you the main details you need to enter a manual claim.

Output File: save a csv file that you can open in a spreadsheet program to amend details before uploading to HMRC.

Further Considerations

- Employment Allowance: If the pay periods included in this claim include some available Employment Allowance you may need to alter the total for NI reclaim and also the total claim figure to account for this. Use your corrected figure when manually entering on the HMRC portal or edit the output file before you upload to the HMRC portal. Please check the latest HMRC guidance on this matter.

- Statutory Payments: The UK government has indicated that payments for statutory leave such as maternity pay should be based on an employee’s normal pay, not their furlough pay. This means if an employee goes on statutory leave a few months after they have been furloughed you may need to manually enter the value for Average Weekly Earnings in their statutory pay calculation rather than using the automated value which will be based on furlough pay they received. As an example, to calculate average weekly earnings for SMP you average the employee’s gross earnings over a period of at least eight weeks up to and including the last payday before the end of their qualifying week. The qualifying week is the 15th week before the week the employee’s baby is due.