Please note, whilst every effort has been made to ensure this information is correct, please check with HMRC if unsure.

Income Tax

| Tax Bands rest of UK | |

| Rate | Band(£) |

| 20% | 0 – 37,500 |

| 40% | 37,501 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Wales | |

| Rate | Band(£) |

| 20% | 0 – 37,500 |

| 40% | 37,501 – 150,000 |

| 45% | Over 150,000 |

| Tax Bands Scotland | |

| Rate | Band(£) |

| 19% | 0 – 2,049 |

| 20% | 2,050 – 12,444 |

| 21% | 12,445 – 30,931 |

| 41% | 30,931 – 150,000 |

| 46% | Over 150,000 |

Tax Codes rest of UK

Emergency Tax Code – 1250L

L Suffix Uplift +65

M Suffix Uplift +71

N Suffix Uplift +59

Tax Codes Scotland

Emergency Tax Code – 1250L

L Suffix Uplift +65

M Suffix Uplift +71

N Suffix Uplift +59

Student Loans

Threshold Plan 1 – £18,330

Threshold Plan 2 – £25,000

Rate – 9%

Postgraduate Student Loans

Threshold £21,000

Rate 6%

National Insurance

| NI Bands | |||||||||||||

| Pay Period | LEL | ST | PT | UEL | UST | AUST | |||||||

| 2018-19 | 2019-20 | 2018-19 | 2019-20 | 2018-19 | 2019-20 | 2018-19 | 2019-20 | 2018-19 | 2019-20 | 2018-19 | 2019-20 | ||

| Weekly | 116 | 118 | 162 | 166 | 162 | 166 | 892 | 962 | 892 | 962 | 892 | 962 | |

| 2 -Weekly | 232 | 236 | 324 | 332 | 324 | 332 | 1,783 | 1,924 | 1,783 | 1,924 | 1,783 | 1,924 | |

| 4 -Weekly | 464 | 472 | 648 | 664 | 648 | 664 | 3,566 | 3,847 | 3,566 | 3,847 | 3,566 | 3,847 | |

| Monthly | 503 | 512 | 702 | 719 | 702 | 719 | 3,863 | 4,167 | 3,863 | 4,167 | 3,863 | 4,167 | |

| Annual | 6,032 | 6,136 | 8,424 | 8,632 | 8,424 | 8,632 | 46,350 | 50,000 | 46,350 | 50,000 | 46,350 | 50,000 | |

| LEL = Lower Earnings Limit ST = Secondary Threshold | PT = Primary Threshold UEL = Upper Earnings Limit | UST = Upper Secondary Threshold AUST = Upper Secondary Threshold for Apprentices | |||||||||||

| NI Rates (Employee) (%) | NI Rates (Employer)(%) | ||||||

| Band | A,M,H | B | C | J,Z | A,B,C,J | M,Z | H |

| <LEL | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

| LEL to Threshold | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

| Threshold to UEL | 12 | 5.85 | Nil | 2 | 13.8 | ||

| ST to UST/AUST | Nil | Nil | |||||

| >UEL/UST/AUST | 2 | 2 | Nil | 2 | 13.8 | 13.8 | 13.8 |

Statutory Payments (Weekly)

SAP/SMP Rate – 148.68

SPP/ShPP Rate – 148.68

SSP Rate – 94.25

Small Employers’ Relief Threshold

£45,000

Automatic Enrolment & Pensions

| Weekly | 2 Weekly | 4 Weekly | Monthly | Quarterly | Bi-Annual | Annual | |

| Qualifying Earnings Lower Threshold | £118 | £236 | £472 | £512 | £1,534 | £3,068 | £6,136 |

| Automatic Enrolment Trigger | £192 | £384 | £768 | £833 | £2,499 | £4,998 | £10,000 |

| Qualifying Earnings Upper Threshold | £962 | £1,924 | £3,847 | £4,167 | £12,500 | £25,000 | £50,000 |

From 6 April 2019 onwards Employer Minimum Contribution is 3%, Total Minimum Contribution is 8% (Including 5% Employee Contribution)

Company Cars

Appropriate Percentage (2019/2020)

| CO2 Emissions | Electric, Petrol, RDE2 | Diesel (Not RDE2) |

| 0-50g/km | 16% | 17% |

| 51-75g/km | 19% | 20% |

| 74-94g/km | 22% | 23% |

| 95g/km | 23% | 27% |

| Each additional 5g/km | +1% | |

| Maximum benefit | 37% |

HMRC Advisory Fuel Rates from 1 Dec 2018 (Pence per mile)

| Engine Size | Petrol | LPG |

| 1400cc or less | 12p | 8p |

| 1401 to 2000cc | 15p | 10p |

| Over 2000cc | 22p | 15p |

| Diesel | ||

| 1600cc or less | 10p | |

| 1601 to 2000cc | 12p | |

| Over 2000cc | 14p | |

Fuel Scale Charge (2019/2020)

The taxable benefit is obtained by multiplying the fuel scale charge of £24,100 by the appropriate percentage used to calculate the car benefit. Company van fuel benefit surcharge £655.

Current Approved Mileage Allowance Rates

| First 10,000 miles | Each subsequent mile | |

| Privately owned car | 45p | 25p |

| Bicycle rate | 20p | 20p |

| Motorcycle rate | 24p | 24p |

| Passenger rate (each) | 5p | 5p |

Miscellaneous

| National Minimum Wage | ||||

| Apprentice Rate (U19) | Apprentice Rate | Age 16 and 17 | Age 18 and 20 | Age 21 to 24 |

| £3.90 | £3.90 | £4.35 | £6.15 | £7.70 |

| National Living Wage | ||||

| Age 25+ | ||||

| £8.21 | ||||

| Construction Industry Scheme | |

| Registered Rate (Matched Net) | 20% |

| Unregistered Rate | 30% |

| VAT Rate | 20% |

Employment Allowance

£3,000

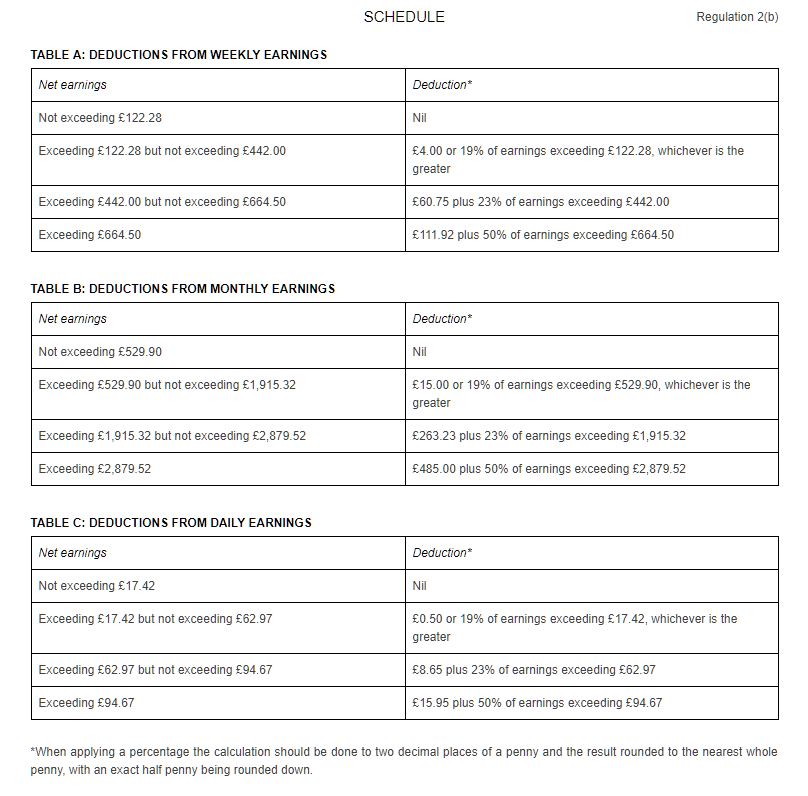

Scottish Earnings Arrestment Orders