7 auto enrolment tips for small businesses

Small businesses across the UK are being urged to start preparing ahead of their upcoming staging dates – the deadline they need to comply with the changing workplace pensions laws. They’ll be joining thousands of larger businesses who have already gone through the staging process. Here are some auto enrolment tips from payroll professionals and companies that have already been through the process:

1) Prepare as far ahead as possible

With so many tasks that must be completed to achieve automatic enrolment compliance it is important to give yourself time to prepare properly and avoid any rushed decisions that could have later consequences. The Pensions Regulator recommends starting to prepare 12 months before your staging date. Once you know your staging date you should start thinking about the steps you need to take to make sure you will be compliant. Click here to read 9 auto enrolment responsibilities for employers.

2) Compliance isn’t optional

There are some business who have already staged that had to learn the hard way that The Pensions Regulator is taking non-compliance very seriously and will fine businesses who don’t meet their obligations. Dunelm Soft Furnishings hit the headlines for all the wrong reasons earlier in the year, and faced a bill of £143,000 for underpaid pension contributions when it got auto enrolment wrong. The Pensions Regulator also revealed in October that it had started to issue the first fixed penalty fines of £400 with executive director for auto enrolment, Charles Counsell, stating:

“As we deal with smaller employers, we will see more who, despite our message to prepare early, leave it too late or do not comply at all. This type of non-compliance is not acceptable. We expect to see the number of times we need to use our powers increase.”

3) Keep things simple

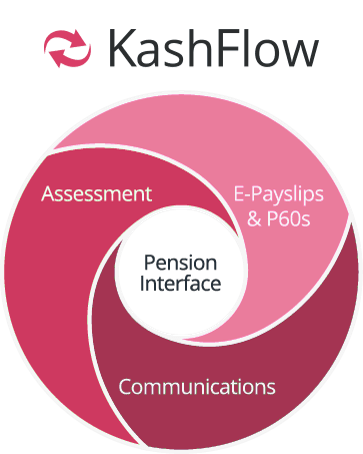

Auto enrolment can be complex with complicated legislation outlining what business owners can, can’t and should do. But this doesn’t mean that the process of handling auto enrolment needs to be complex too. Some businesses that have already staged agree that the key to success is keeping things as simple as possible. This means having a complete solution, such as KashFlow Payroll’s auto enrolment solution, which will manage all of your key tasks automatically, rather than several different systems which involve human intervention (leading to human error). Having the right software in place is vital. Click here to find out more about KashFlow Payroll and it’s complete, end-to-end auto enrolment solution.

Auto enrolment can be complex with complicated legislation outlining what business owners can, can’t and should do. But this doesn’t mean that the process of handling auto enrolment needs to be complex too. Some businesses that have already staged agree that the key to success is keeping things as simple as possible. This means having a complete solution, such as KashFlow Payroll’s auto enrolment solution, which will manage all of your key tasks automatically, rather than several different systems which involve human intervention (leading to human error). Having the right software in place is vital. Click here to find out more about KashFlow Payroll and it’s complete, end-to-end auto enrolment solution.

4) Payroll is central to AE ease

Because your payroll process has access to employees’ PAYE information, and runs the calculations which must be completed before employee assessment can occur, it is only logical that the assessment process should also take place within payroll, to make the process as efficient as possible. Sandra Crawford from Silverstone Circuits explains the benefits of assessing employees within the payroll for their business:

“We use a lot of zero hours staff so some months they may not be earning anything and then for the next 3 or 4 months they would be assessed as over the limit. Every time I run the payroll it re-assesses employees. I get notifications every time and the information is all there.”

Providing communications to employees and deduction information to your pension provider at each pay period is also vital and must be generated by payroll.

5) Test, test and test some more

Ensuring your systems are ready in plenty of time for automatic enrolment is key, so make sure all your employee information is correct and up-to-date and that your payroll software can produce a pensions output file in the correct format for your pensions provider. It is always best to test your systems and iron out any issues prior your staging date instead of trying to rectify problems later. The Pensions Regulator’s website states:

“Inaccurate records or missing data can have serious consequences, which can include staff being automatically enrolled at the wrong time, information about automatic enrolment not getting to the staff member, and the wrong amount being paid to your staff at retirement. It is your responsibility to ensure that records are correct and up-to-date.”

6) Work with trusted advisors

The right advice from the right sources will make a real difference during the auto enrolment process. So seek support from The Pensions Regulator, Independent Financial Advisors, Pensions Providers and Payroll Companies. Make sure you work with a payroll provider, like KashFlow, with a proven track record of handling auto enrolment within their software and who can provide you with the training and support that you need.

7) Streamline

Streamlining your auto enrolment process can makes things much less complicated. Read these 5 tips for streamlining and simplifying.