If you get an error on a bank reconciliation advising that you that transactions have been edited, added or deleted since your reconciliation was completed then this will unbalance previously completed reconciliations due to the data entered no longer being applicable. Use the steps below to diagnose and correct this;

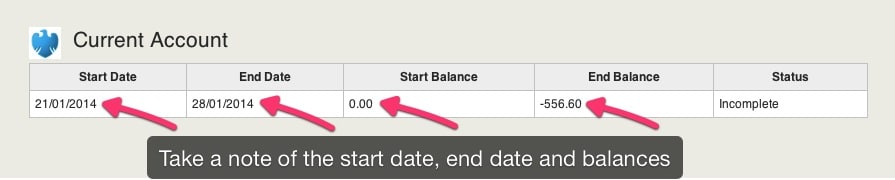

Step 1 – Take notes

Go to Bank > Reconcile > Previous Reconciliations and take a note of your latest reconciliation dates, starting balances and ending balances.

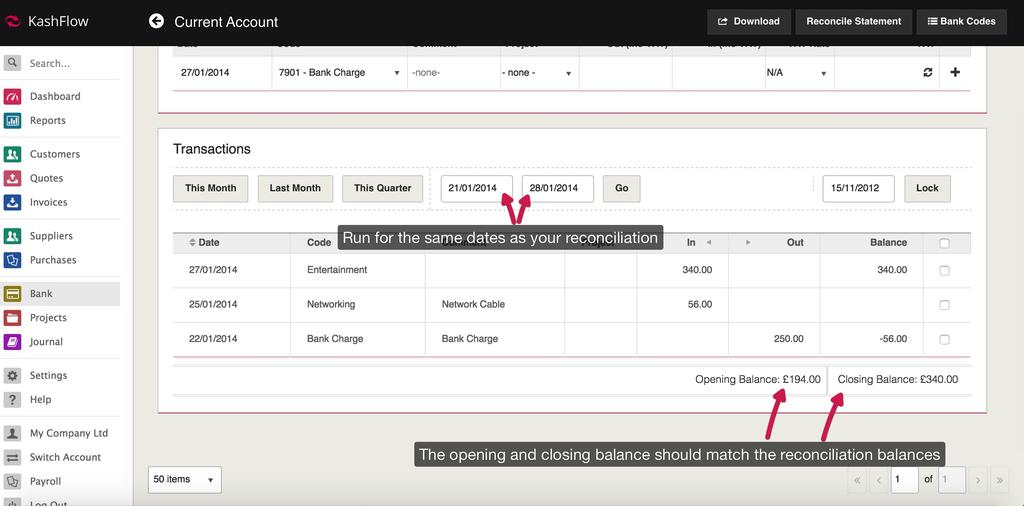

Step 2 – Compare to the View/Add Transactions screen

Go to Bank > View/Add and compare the balances that are on your previous reconciliation screen to the ones listed here. Start with the latest and work backwards until you find one that matches.

The point where they match is the last correct reconciliation. From that point onwards something has changed. This could be that a transaction date has changed, a transaction has been edited, added or deleted.

You will need to abandon all reconciliations from this point onwards and re-reconcile. You can then identify the transaction that has been modified, correct it and then re-reconcile again.

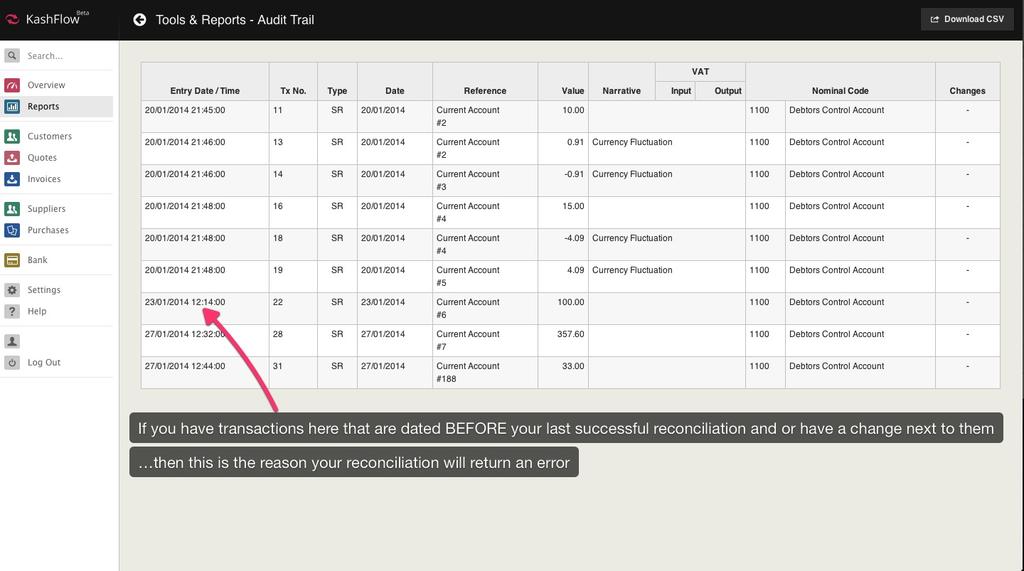

The Audit Trail

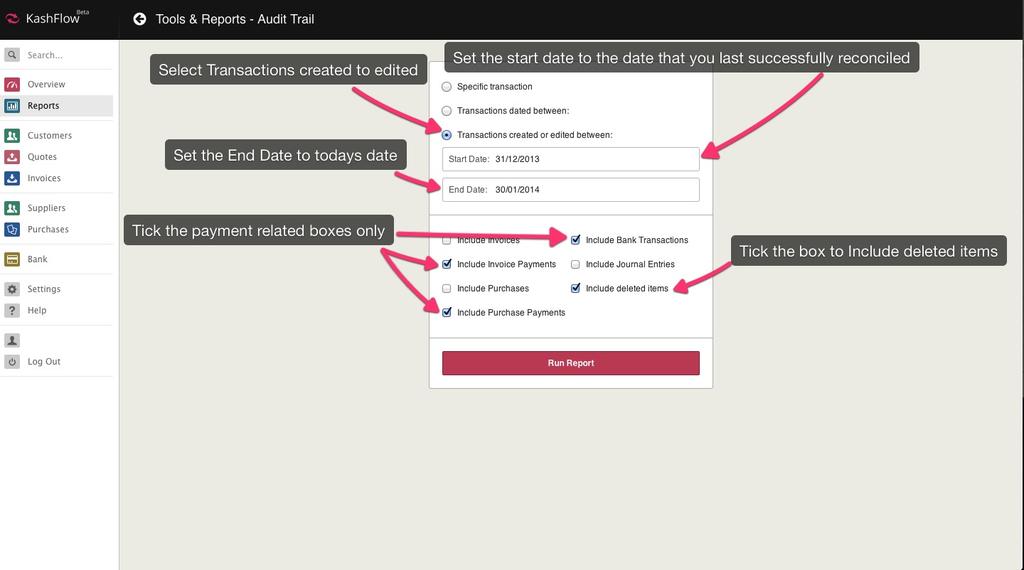

You may be able to identify what transaction has been modified and when by using the audit trail. Access that by going to Reports > General Reports > Audit Trail > Set the start date to the date that you did your last reconciliation successfully and the end date to today > Set it to ‘transactions created/edited between these dates’ > Tick the box for deleted items to be included > Set the report to include invoice payments, purchase payments and bank transactions only > Click run report.