Purpose/Background

The employee Holiday Configuration is found under the Holiday Configuration tab in the Employees | Calendar & Leave menu is laid out in a similar manner to the Company Level Holiday Scheme Configuration.

Where a Company Level Holiday scheme exists and the employee has been created after the scheme was saved, the values from company level will be carried over to the employee level scheme. Values can be adjusted at any time, even when a Company level default values have been carried over.

The fields reflected on this screen perform in the same was as those in the Company Level Holiday Scheme Configuration.

If the employee’s Holiday Type is Hours, Days or Weeks, the only additional field that is displayed is, ‘Hours/Days/Weeks left.’ and is populated with the entitlement that the employee has remaining.

If the employee’s Holiday Type is % Accrual – Money/Hours/Days/Weeks the only additional field is ‘Accrued’ and is populated with the amount of money or time the employee has accrued.

Accrual schemes will always use the Payslip/Statutory Items set up at company level to apply the accrued holiday to the employee on payrun finalisation,

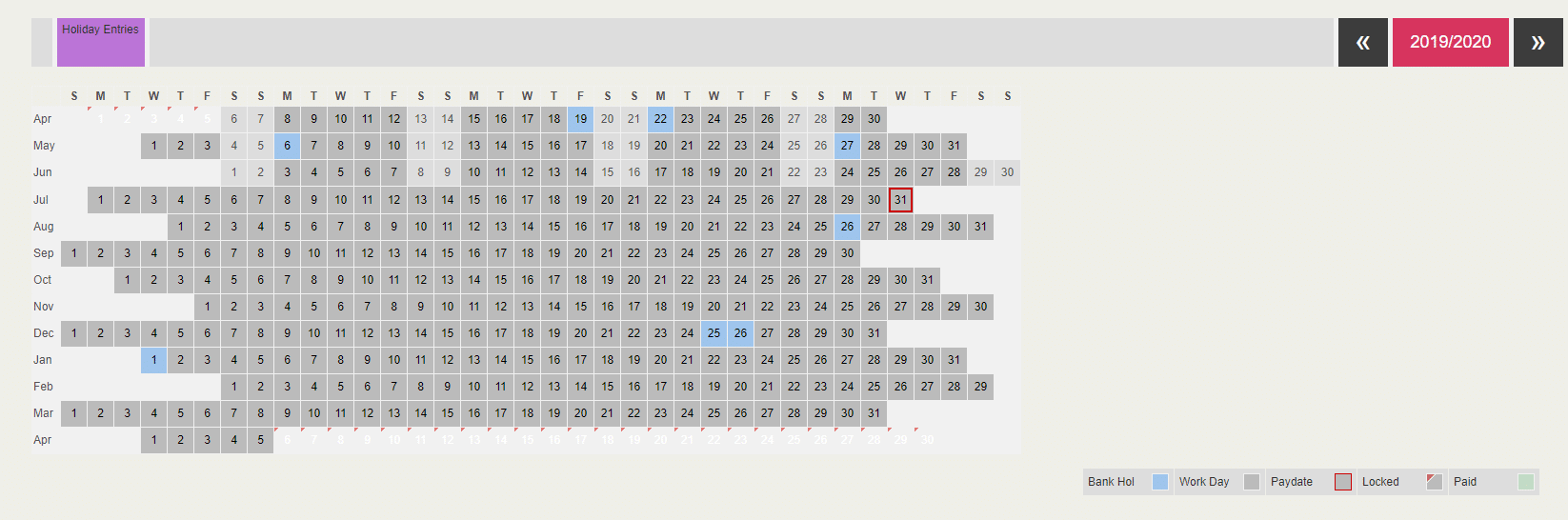

Holiday Calendar

The calendar on the Employee Holiday Configuration screen is view-able by tax year and can be toggled so holiday entries can be added in both the past and future.

Select a single day or drag across multiple days without a gap on the calendar to display a holiday entry dialogue.

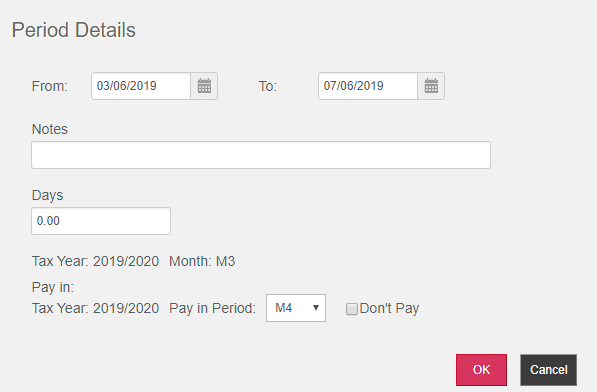

Change the From and To Dates and on save these will be adjusted in the calendar to reflect the new dates selected in the Date picker.

Notes can be added which are later view-able when clicking on a saved holiday entry or in absence reports.

The number of Hours/Days/Weeks/Value displayed will be calculated based on your choices. This will be the 1 Day represents value entered for the employee multiplied by the number of days selected. i.e 1 Day Represents 8 Hours x 3 Days = 24 Hours. Selected dates will not be included in the calculation if you chose to not Include in Bank Holidays or if they are Non-working days for that employee. The calculated value is editable.

The tax year that the Holiday entry has been entered in and the Week or month (Payroll frequency dependent) that the Holiday entry is displayed.

Specify the Pay Period in which you want that Holiday to be paid, the default being the current period.

Alternatively check the ‘Don’t Pay’ checkbox to omit adding the Holiday Pay to the employee’s payslip.

Holiday Pay will use either the Holiday Pay Rate or the Accrual Pay Rate dependent on the Holiday Type selected. This is multiplied by the total value of the holidays within the pay period. Where % Accrual – Money is selected you cannot select the month for it to be paid in as this is not relevant.

Click OK to save the Calendar entry and update the employee’s Holiday Remaining or Accrued value with the value entered for that holiday entry. A negative total will be left if the value exceeds the Holiday Remaining/accrued value.

Calendar entries can be deleted if the period it falls in has not been finalised. Roll back of a period is required to delete a finalised period.

Deleting and Modifying a Holiday Entry

When you first create a Holiday entry in the calendar their will be no option to Delete the Holiday record as the holiday is not yet created so you will only be presented with ‘Ok’ and ‘Cancel’ choices.

When an existing holiday entry has not yet been paid it can be deleted. Once deleted the entitlement or Accrued value will be increased to reflect the number of Units that were removed.

Where a holiday period has been paid and the calendar entry is opened the Delete button will no longer be displayed. The calendar entry can only then be deleted if the period that the holiday was paid in is rolled back so the longer is now unpaid. As an alternative you can add manual holiday pay adjustments on the payslip and update the entitlement or accrued value manually.

Follow the link for an explanation of how the calendar creates Holiday Pay Payslip Items .