Welcome to your software update for April 2015.

This update of the software is focused on legislation amendments. These notes provide information on all the improvements such as:

- Employment Allowance

- Employer National Insurance

- Full Payment Submission

- Statutory Adoption Pay

- Income Tax

- Changes to Parental Leave

- Pensions

- Legislation

- Help and Support

Employment Allowance

The Employment Allowance remains at a maximum of £2000 in the tax year, providing you are still eligible. To check that you are claiming Employment Allowance, go to Company, Setup Details, Government and ensure the Employment Allowance box is selected. Otherwise you may receive an underpayment notification from HMRC.

Employers National Insurance

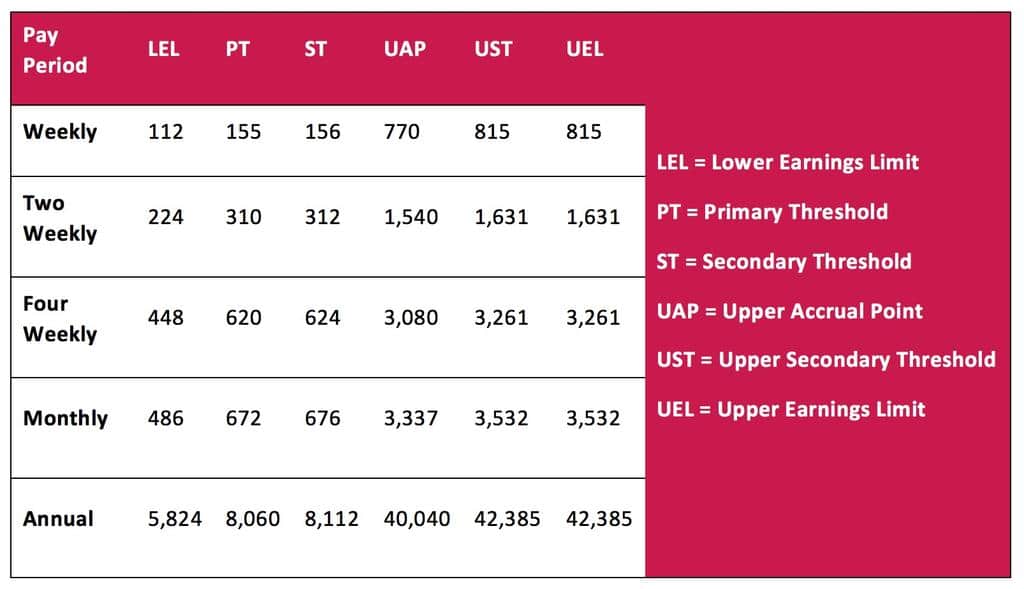

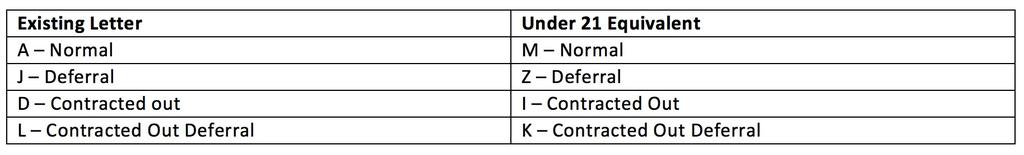

From 6th April 2015, following changes by the Chancellor announced in the Autumn Statement 2013, employers will not be required to pay Class 1 secondary NICs on earnings up to a new ‘Upper Secondary Threshold (UST)’ for employees who are under the age of 21. Class 1 secondary NIC will continue to be payable on all earnings above the new Upper Secondary Threshold.

The following NI letters have been added to the software and are shown in the table below:

Upon completing your Year End process, any employee under 21 will have their NI Rate changed automatically as per the table above. It is therefore important to ensure that all employees’ dates of birth are entered correctly into Employee, Setup Details. Also, when an employee reaches 21 the NI Rate will again be automatically changed as per the table above.

If you are advancing for holidays where the usual pay day in an advanced pay period is after the employee’s 21st birthday, the NI will be calculated over the 2 applicable NI letters and the payment record will hold the full details.

If you are paying multiple weeks, for example:

■ Pay week 1

■ Then pay week 3 – the employee’s 21st birthday falls within week 3

■ The NI will be treated as if advancing for holidays and week 2 would be based on an under 21 NI letter and week 3 would be based on an over 21 NI letter

Note: If you adjust the number of NI weeks, this would negate the NI split and force a single letter calculation.

Full Payment Submission

From tax year 2015/16, the following fields are mandatory for employees with an NI Rate of D, E, I, K or L and therefore require completion prior to submitting the FPS:

■ SCON number

■ ECON number

Any ASPP and ShPP paid from 2015/16 tax year will be reported in the ShPP value field on the FPS.

Note: An FPS submission will fail if you have employees with NI letters D; E; I; K or L and an ECON number is not present.

Employer Payment Summary

For information purposes, Employment Allowance has also been added EPS confirmation screen and the EPS confirmation report.

The following fields have been renamed on the EPS:

■ From tax year 2015/16 any reference to OSPP will now be SPP

■ From tax year 2015/16 any reference to ASPP will now be ShPP

Statutory Adoption Pay

Statutory adoption pay has now been increased to match maternity pay. This will be paid as 6 weeks at 90% of the average weekly earnings, followed by 33 weeks at the standard weekly rate, or 90% of the average weekly earnings – whichever is lower. The Statutory payment rates have been increased. Compensation and recovery remains the same.

Income Tax

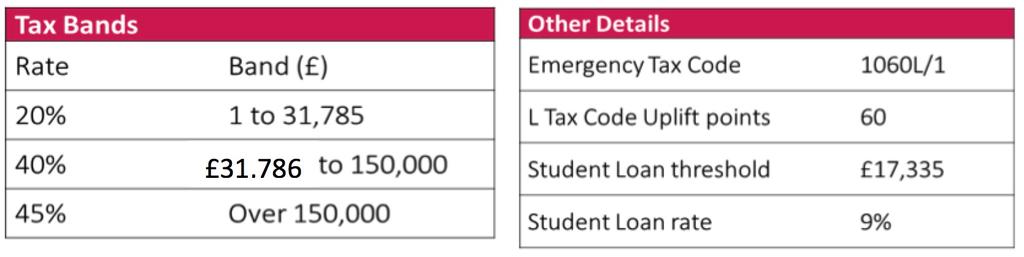

There have been changes to the tax rates. The tax threshold has also been increased by £600 so the standard tax code is now 1060L.

Marriage Allowance

Marriage Allowance has been introduced for married couples or civil partners. This will allow an employee who is not liable for income tax above the basic rate to transfer up to £1,060 of their personal allowance to their spouse or civil partner. These are identified by two new suffix tax code letters; M and N. You will receive a tax code notification from HMRC if any of your employees require this tax code change.

50% Tax Limit

A limit of a 50% tax deduction of gross taxable earnings for all tax codes has also been introduced. If this results in outstanding tax and the employee is on a cumulative tax code, this will then potentially be recovered in future pay periods.

Changes to Parental Leave

Following legislative changes there have been amendments to parental leave from the 2015/16 tax year:

■ Additional Statutory Paternity Pay and Leave will be abolished for babies due/placed on or after 5th April 2015

■ Shared Parental Pay and Leave will be introduced for parents where the child is due/ placed on or after 5th April 2015

Shared Parental Leave

Shared Parental Leave is a new entitlement allowing eligible mothers, fathers, partners or adopters to choose how to share time off work after their child is born or placed. It is thought this will give parents more flexibility to share the care for their child in the first year following either birth or adoption. Shared parental leave will allow both parents to share the leave, which can be taken at the same time or separately. SMP and OSPP (renamed SPP) remains unchanged.

To enable you to create a record for ShPP when starting a new Shared Parental Pay period, it is necessary to enter some mandatory information to allow calculation of the amounts due each period. The following fields require completion:

■ First Day to Have ShPP

■ Partner’s Surname

■ Partner’s Forename

■ Partner’s NI Number

■ Number of ShPP Weeks to Pay

Pensions

Pension Parameters for Auto Enrolment have been updated for the tax year 2015-2016. The State Pension Age has been updated for 2015-2016.

Legislation

Student Loan The Student Loan Threshold has increased to £17335.

Tax, NI, SSP, SMP, SAP and SPP The rates for tax, NI and statutory payments have been updated for 2015-2016.

Tax Code Changes In line with legislative changes, moving into the new tax year (2015/16) will automatically uplift tax codes as required.

Help and Support

HMRC Online Service Helpdesk

Tel: 0300 200 3600

Fax: 0844 366 7828

Email: [email protected]

HMRC Employer Helpline

Tel: 0300 200 3200

HMRC Employer Helpline (for new business)

Tel: 0300 200 3211

KashFlow Payroll Support

Email: [email protected]