Should a basic business use just a spreadsheet for their accounts?

A thread on UK Business Forums caught my attention today. Kelvin White is a driving instructor and asks for accounting software recommendations for his small business. He is in fact a sole trader driving instructor. He has no need to file VAT returns or issue invoices to his customers. As well as the usual recommendations, some people suggested that as his requirements are simple, he should just use a spreadsheet.

A thread on UK Business Forums caught my attention today. Kelvin White is a driving instructor and asks for accounting software recommendations for his small business. He is in fact a sole trader driving instructor. He has no need to file VAT returns or issue invoices to his customers. As well as the usual recommendations, some people suggested that as his requirements are simple, he should just use a spreadsheet.

Forgetting for a moment the room for human error in using a spreadsheet, it is in fact a perfectly good tool for simply keeping a record of the income and expenditure for this type of business.

So, should Kelvin just use a spreadsheet? If all he wants to do is record basic accounting data, it’ll probably suffice. What those that recommend a spreadsheet seem to overlook is the fact that your accounts are much more than just the data needed for the tax man at the end of the year.

Your accounting data is the underlying information about your business and if it’s recorded in a proper accounting application like KashFlow then you can get so much more useful information from that data.

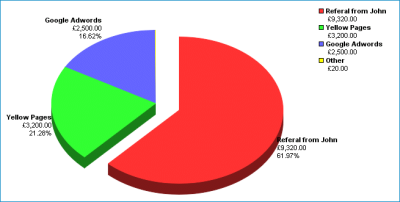

As an example: with a spreadsheet Kelvin would have a hard time analysing where his new driving students come from – ie, how they hear about his services. With KashFlow you simply tag each new customer with the relevant source of business from your list of sources. This means you can, in just a couple of clicks, see instantly what sources of business work for you and which don’t.

Income By Source

This is just one of the many non-accounting type reports that can be generated from your accounting data and give non-accountant types insights into their business.

Additionally, the services Kelvin sells and the business-related purchases he makes can also be tagged so that when it comes to self-assessment time, the majority of the work is already done and the numbers for most boxes on the self assessment form are calculated. Thus reducing the bill he’ll get from an accountant at then end of the year.

An accounting application will give you the tools you need to reconcile your accounting entries against your bank account to make sure everything is entered correctly.

Yes, in theory a spreadsheet can also do all of the above. But the more you want the spreadsheet to do, the more laborious data entry becomes and the more room for error.

In summary, I think it’s quite short-sighted to see accounting as just something you have to do to keep the tax man happy and therefore opt for the most basic option possible for inputting data without considering the importance of getting useful intelligence back from that data.