Introducing KashFlow’s New Mileage Module

Sole traders and partnerships who use HMRC’s “simplified expense” method must log all the trips they make for work and claim back the mileage from their business.

The amount they can claim back is variable depending on the number of miles they travel in the Tax Year. We understand that keeping track of all business trips and the relevant information can be challenging; calculating the distance and remembering to note it down, as well as knowing the correct rate which can be claimed each time you make a journey. This can often result in miscalculations for mileage claims.

We have added a brand-new additional module to KashFlow to tackle this issue and make it even better bookkeeping software for multiple businesses. Our new ‘Mileage module’ can now be found in the main menu and comes with a whole range of exciting and helpful features that will help you calculate, track and log all your business miles easily. This will ultimately ensure that you’re getting the maximum benefit you’re entitled to under the HMRC’s business mileage guidelines.

What’s new?

You can now find the Mileage module in the main navigation menu. When you first click into the Mileage option you will be presented with the Mileage settings menu where you will need to tick the ‘Enable Mileage’ option to activate the mileage module and enter the rest of the relevant details such as if you wish to include your mileage on your Self-Assessment, and the default vehicle. Once you have completed this page, clicked ‘update’ the mileage module will now be enabled.

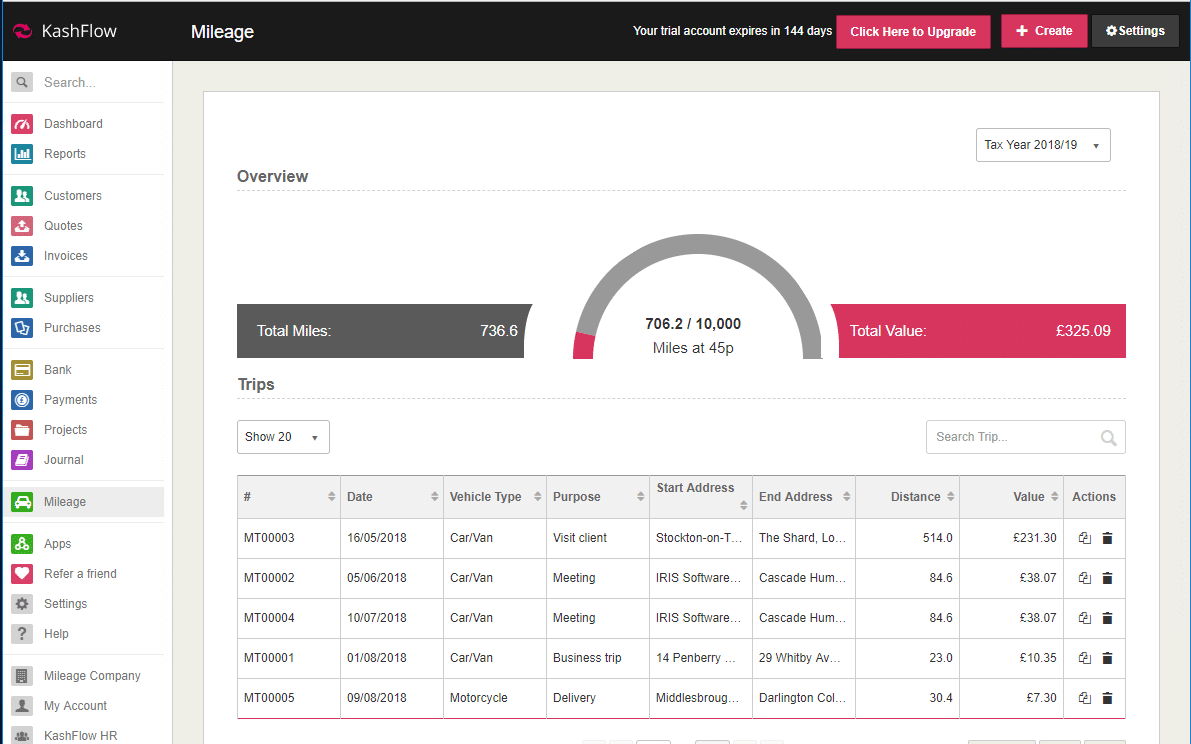

Clicking into the Mileage option in the main KashFlow menu will now provide you with a fresh, easily-to-navigate mileage dashboard that provides you with an easy-to-understand mileage tracker displaying the total amount of miles you’ve covered to-date in the selected Tax Year. It also provides you with a great, summary list of all the journeys you’ve completed in your chosen financial year, providing you with the date, destination and distance travelled as well as the value of the trip. You can easily duplicate a trip if it is a common commute, search for specific trips or delete a journey if you have entered it in error. You can also export this list of trips into a CSV excel file, email or print them by using the buttons at the bottom.

The animated mileage tracker provides you a quick-glance illustration of the number of miles you have travelled in the selected Tax Year and the total value of those miles. You can change the Tax Year you wish to view in the top right of the menu, providing you with an overview of previous year’s records.

The mileage tracker will clock the number of miles you have travelled, filling up with our signature KashFlow pink until reaching 10,000 miles logged. After 10,000 miles KashFlow will continue to track your logged journeys and continue to provide you with a total mileage count, but the mileage tracker will not rise any further and remain full at 10,000 miles. This is because the tax rate per business mile changes from 45p to 25p for each mile above 10,000. For more information on Mileage Allowance Payments you can visit the official HMRC website here.

Adding a journey, google integration and attaching receipts

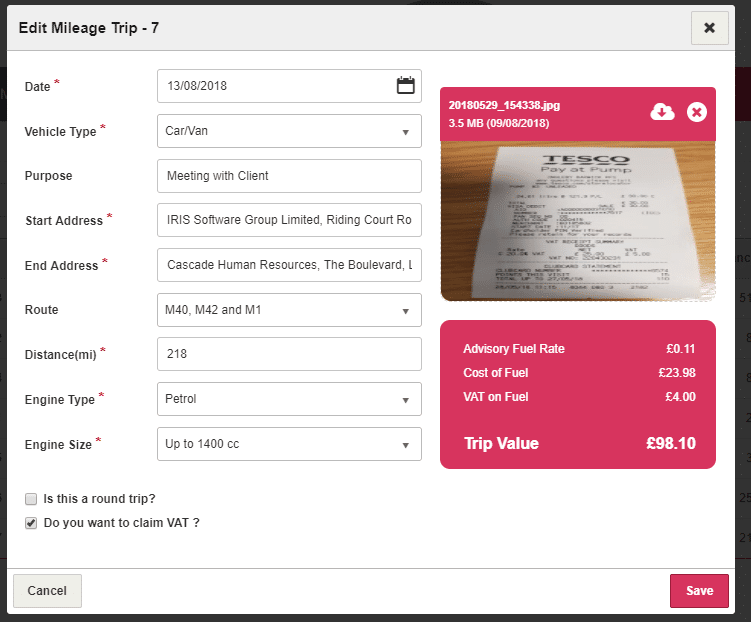

You can add new trips by clicking ‘Create’ at the top of this screen. From here, a simple menu will open where you can enter the relevant details of the trip including date, vehicle type, start and end address, and the purpose of the trip.

Once you begin to type the start or destination address KashFlow will link with Google Maps to suggest relevant addresses. This will then allow Google to suggest the most direct route you may have taken and automatically fill out the distance (in miles) for you. You can easily change the route taken by selecting the drop-down menu and selecting the route you took. If the route you took does not appear you can select ‘custom’, allowing you to enter in the distance (in miles) manually.

You can also attach images of receipts using the Dropbox integration tool (you will need to have this turned on in your account) within this menu.

By clicking ‘Is this a round trip?’, KashFlow will automatically double the distance. You can then save your journey and it will be added to your list of trips and automatically update the mileage tracker and totals.

Including mileage in Self-Assessment

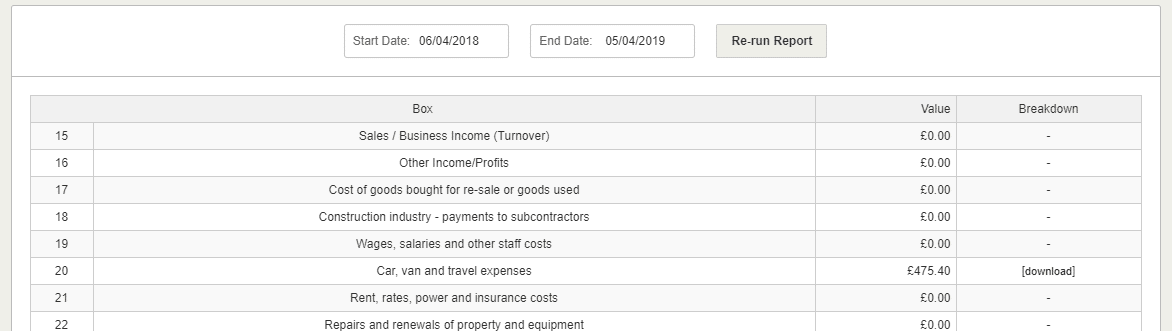

Upon activating the mileage module, you will have the option to ‘Include Mileage in Self-Assessment SA103’. This means that every time each time you upload a journey, it will be linked to the SA103 form which can then be downloaded for your Self-Assessment.

You can learn more about the specifics of this feature on our support page.

To start a free trial of KashFlow and see this feature in action, just click here!