What is Expense Management?

We’ve partnered with Cashplus to help KashFlow customers manage their expenses using a prepaid card solution.

We’ve already given expense management a brief introduction, but we wanted to delve deeper in what expense management actually is and how it can help your business. If you’ve any questions, or insights into how you manage expenses in a small business then leave us a line in the comments below – we’d love to hear from you!

What is expense management?

Expense management is the system a business uses to process, pay and audit their business spend. These costs normally include employee travel and entertainment. Expense management systems can also be used for sole traders to manage and monitor their business spending.

Expense management has two key elements: how a business pays for their items and how they track that spend.

Is expense management difficult?

Managing expenses can be a difficult task, especially if you’re processing expenses from multiple employees. Without a proper system in place, you will quickly find yourself becoming confused with the number of receipts. It can be hard to establish an audit trail if expenses aren’t processed immediately, and finding the time to process expenses as they come through can be equally difficult when you’re a small business.

Delaying the processing and payment of personal expenses could produce problems in both your personal and business cash flow. If you delay in paying employee expenses, then you may also face problems with reduced morale.

Unfortunately, delays can be common when you use a manual system – which is why it’s worth looking at expense management tools like those available in KashFlow. Our bookkeeping software will allow you to enter and track your expenses from one place.

We’ve also recently introduced a “Quick Add” feature that means you can add out-of-pocket expenses like coffee, food or transport tickets with just one click. Systems like this mean that you’re no longer stacking receipts up until you have a chance to sort through them, you’re simply logging them and paying them as you go! Take a look.

Employee expense management policy

One of the most effective ways to manage employee expenses through your business is to create a company expenses policy. A company expenses policy should outline what you will and won’t pay for.

You should make sure that your expenses policy is clear and concise; too much small print will lead to confusion. If it isn’t clear whether or not an expense is permitted, employees will likely try to apply for it. This creates a lot of paperwork – so taking the time to clarify and pare down your policy in the beginning will save you admin time in the long run.

Once you’ve created your policy, you should make it easily visible to your employees. This will help cut down on invalid expense applications, which will reduce your admin and free up more of your important time.

As the ultimate owner of the business and of the expenses policy, it’s your duty to ensure it remains up-to-date and evolves in line with your business. You may find the policy needs updating as employee numbers increase or the business expands to incorporate new and different types of expense.

What to include in an expense management policy

Your expense management policy should set out what is and isn’t classed as a work-related expense.

There are two main types of employee expense: ones that paid directly by the company on an employee’s behalf, and ones that the employees pay and then claim back (reimbursement).

Many expenses are related to business travel, so make sure your policy includes trains, taxis, petrol (if employees are using their own car) etc. If the travel is international, include sections covering legal document expenses like Visas and any vaccination or medical expenses needed.

You may also include an allowance for business materials or meals purchased on the trip.

It makes sense to include an expense cap so that you can effectively budget. You may, for example, agree to reimburse a meal up to £15 – with the employee covering the rest of the cost themselves.

For further clarity, you could also include a list of non-reimbursable expenses like:

- Expenses incurred by “plus-ones” or non-employees who join your employees on a business trip

- Any unauthorised upgrades, such as first class travel or hotel suites

- Any personal purchases made on a trip, such as clothes or a massage

- Fines incurred during the trip (like speeding tickets)

- Personal trips

You may also want to include disclaimers so that you aren’t liable to replace lost personal property like luggage.

Your expense management policy doesn’t necessarily have to be comprehensive, as it will evolve to suit your employees and business. Employees should be encouraged to clarify whether their expenses are permitted.

It’s best to create a business culture where, if employees are unsure of whether an expense will reimbursed, they check with you in advance. This can help prevent problems such as you having to pay out for unnecessary expenses, or employees becoming resentful when they have to pay for what they thought was a business expense.

Managing your business expenses

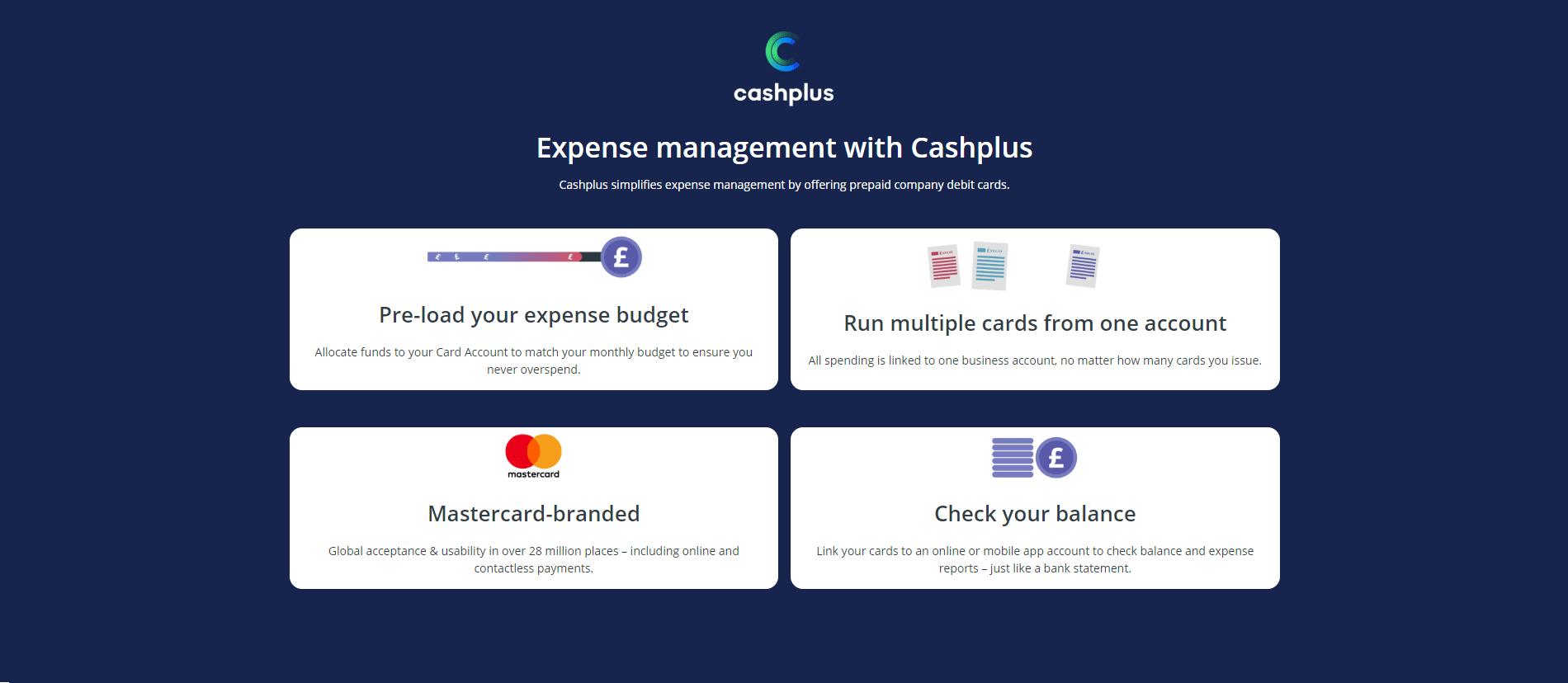

When it comes to managing your business expenses, Cashplus offer an ideal solution with their prepaid expense card. Prepaid cards mean you don’t have to use petty cash or personal funds to cover your business expenses or rely on employees to cover the costs before you can pay them back.

Multiple cards can be issued from one bank account, meaning employees or subcontractors can use a card – reducing the sign-off process and speeding things up. Cashplus cards can also be pre-loaded with an expense budget so that you never overspend.

Generally speaking, expense cards help cut out the middleman by cutting down on the amount of paperwork you have to do each time an expense is filed. They also offer you an opportunity to centralise your expense management function, so that all outgoing business costs come from the same place. This also creates a much simpler audit trail.

To learn more about KashFlow and Cashplus and how you can save with our exclusive offer, click here: https://www.kashflow.com/expense-management