VAT MOSS – now you can create a return in KashFlow

There’s good news for KashFlow customers who sell digital services in Europe, with an update to our VAT MOSS functionality.

As of January 2015 the sale of digital services by UK businesses to customers within the EU, require VAT to be charged at the rate of that customer’s country. Digital services refer to broadcasting, telecoms and e-services, or anything that is delivered electronically over the internet or over the air.

Compliance with the new VAT legislation was made much easier for KashFlow customers, through the introduction of VAT MOSS support in January.

MOSS (for those who are not aware) stands for ‘Mini One Stop Shop’ and is an optional VAT scheme started by the HMRC that allows businesses owners in the UK to report digital services VAT.

If businesses don’t register for MOSS, they would need to register for VAT in each individual European country they trade in. With MOSS, HMRC sends the payment on to the appropriate EU countries based on VAT MOSS returns created by the businesses.

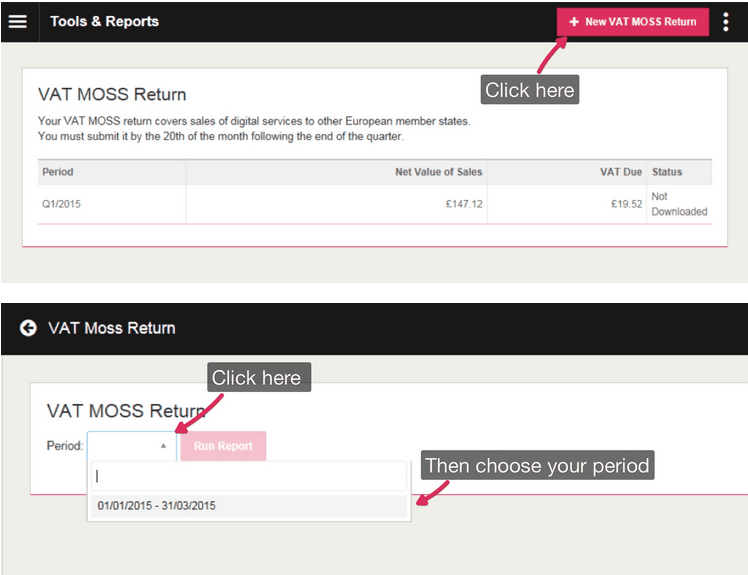

From April 2015, HMRC will require businesses to submit a VAT MOSS return by the 20th of every quarter.

So the good news? The latest VAT MOSS update in KashFlow now enables our users to create a VAT MOSS return, and download it in the required format that can be uploaded to HMRC’s Online Services.

Click here for a step by step guide on creating and downloading a VAT MOSS return using KashFlow. You can also find out more information on setting up MOSS in KashFlow, by clicking here.